PostNL had a very strong and successful financial year in 2020. We benefited from strong parcel volume growth, fuelled by the Covid-19 crisis, which accelerated e-commerce growth, and we collected, sorted and delivered record volumes in our peak season. We delivered greater-than-expected benefits and synergies from the Sandd integration, ahead of time, which had a clear positive material increase in revenue and normalised EBIT. We benefited from higher than expected greeting cards and other single items at a higher margin and gifts being send using letterbox parcels. And we saw business performance at Logistics, Belgium and Spring improve significantly.

We successfully maintained our strict working capital management and agreed on modified payment conditions related to the settlement of the remaining conditional pension benefits, which positively impacted 2020's free cash flow by around €100 million. We successfully executed a €150 million sale-and-leaseback transaction related to 5 sorting centres, and took further steps in de-risking our portfolio and divested Nexive, PCS, Spotta, Adeptiv and Cendris. These developments, together with our strong business performance, resulted in a material improvement of our free cash flow and adjusted net debt position.

Year ended at 31 December | 2019 | 2020 |

|---|---|---|

Revenue | 2,844 | 3,255 |

Normalised EBIT | 135 | 245 |

Free cash flow | 107 | 186 |

Adjusted net debt | 736 | 407 |

Leverage ratio | 2.6 | 1.0 |

Dividend (in € cents) | 0.08 | 0.28 |

The combination of the improved profitability and stronger financial position brought our leverage ratio, being adjusted net debt/EBITDA, to 1.0 in 2020, significantly below our target not to exceed 2.0. In line with our capital allocation priorities this favourable position allows us to invest in the growth of our business activities, including capacity growth, investments related to achieve further cost savings, maintenance capex, investments in working capital and investments in the acceleration of our digital transformation.

Our improved and strong financial position also allows us to re-instate dividend for 2020, just 12 months after the temporary halt due to the Sandd acquisition.

As of 2020, management analyses and reports on PostNL's profitability performance applying the key performance indicators (KPIs) revenue, normalised EBIT and free cash flow.

Normalised EBIT gives a reflection of the Group's operating income performance, in which one-off and significant non-business related items are excluded and explained.

Revenue | Normalised EBIT1 | |||

|---|---|---|---|---|

Year ended at 31 December | 2019 | 2020 | 2019 | 2020 |

Parcels | 1,672 | 2,052 | 120 | 209 |

Mail in the Netherlands | 1,606 | 1,708 | 52 | 96 |

PostNL Other | 81 | 108 | (37) | (60) |

Intercompany | (515) | (614) | ||

PostNL | 2,844 | 3,255 | 135 | 245 |

In 2020, revenue increased by 14.5% or €411 million to €3,255 million (2019: €2,844 million), driven by the acceleration of e-commerce growth within Parcels and the acquisition of Sandd within Mail in the Netherlands. At the same time, Mail in the Netherlands benefited from the higher than expected number of greeting cards and other single items, which have been sent during the lockdown. 57% of our revenue in 2020 was generated from e-commerce related activities (2019: 52%).

In 2020, normalised EBIT was €245 million (2019: €135 million) with a margin of 7.5% (2019: 4.7%), of which around €55 million is estimated to be non-recurring and related to Covid-19 and includes around €15 million of additional compensation to reward our people for all their efforts. Normalised EBIT excludes exceptional items, which amounted to €49 million in 2020, of which €60 million related to the sale-and-leaseback transaction, €(14) million to the Sandd acquisition and €2 million to project costs and other. Compared to 2019, normalised EBIT in 2020 includes €(25) million higher non-cash pension expenses (PostNL Other).

Further information on the bridge from operating income to normalised EBIT is included in note 2.5 Segment information to the consolidated financial statements.

Since the start of the Covid-19 crisis, e-commerce growth has picked up significantly and the transition from offline to online has accelerated. The number of first-time online buyers increased and the share of existing medium and heavy online shoppers grew. Part of the growth related to specific, non-recurring, consumer spending as a result of the Covid-19 situation. To help small- and mid-sized shops move online, we provided a range of services through the MyParcels platform.

While in previous years we significantly scaled up our processing capacity at a few peak moments, in 2020 we had to cater for a more structural scale up. During the first wave of the pandemic we processed considerably more parcels than on average, while at peak moments towards the end of the year volumes were significantly higher than those at the beginning of the year. The end-of-year peak in 2020 also began earlier and lasted longer than we typically see.

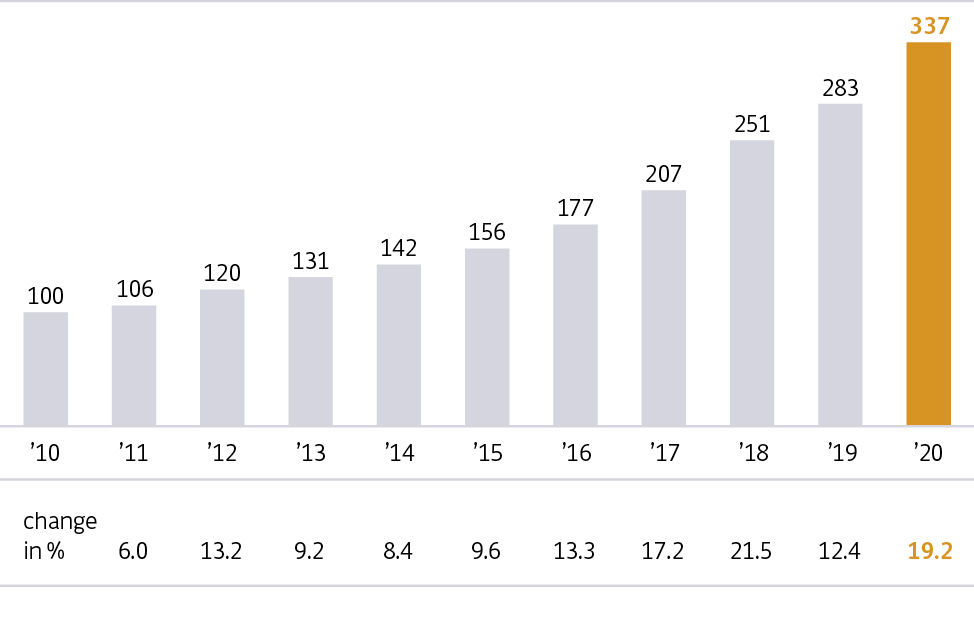

In total, we delivered a record 337 million parcels in 2020, of which we estimate around 25 million to be non-recurring and related to Covid-19. This resulted in strong volume growth of 19.2% in 2020 (2019: 12.4%). Growth was visible across almost all segments and products, especially among small and mid-sized webshops.

|

Revenue at Parcels grew strongly to €2,052 million (2019: €1,672 million), mainly driven by the strong volume growth, fuelled by the Covid-19 crisis, and a positive price/mix effect, thanks to yield management measures (including improved pricing), along with favourable mix effects. Logistics, Belgium and Spring also saw rising revenue, with very strong growth in e-commerce related revenue at Spring, both in Asia and Europe.

Normalised EBIT was up very substantially to €209 million (2019: €120 million), of which around €40 million is estimated to be non-recurring and related to Covid-19. The increase reflects the impact of €219 million from volume growth and a positive price/mix effect of €36 million, partly offset by volume-dependent costs rising by only €154 million thanks to the almost optimum utilisation of our infrastructure resulting from the equal flow of volumes during the week. Organic costs, including higher costs as a result of new labour legislation, increased by €21 million. Operational efficiency improved but was more than offset by higher other costs, partly related to higher IT costs and extra cross-dock capacity, resulting in additional costs of €41 million. Other results were up €49 million, with a significantly improving business performance at Logistics, Belgium and Spring. The performance is driven by top-line growth benefitting from e-commerce.

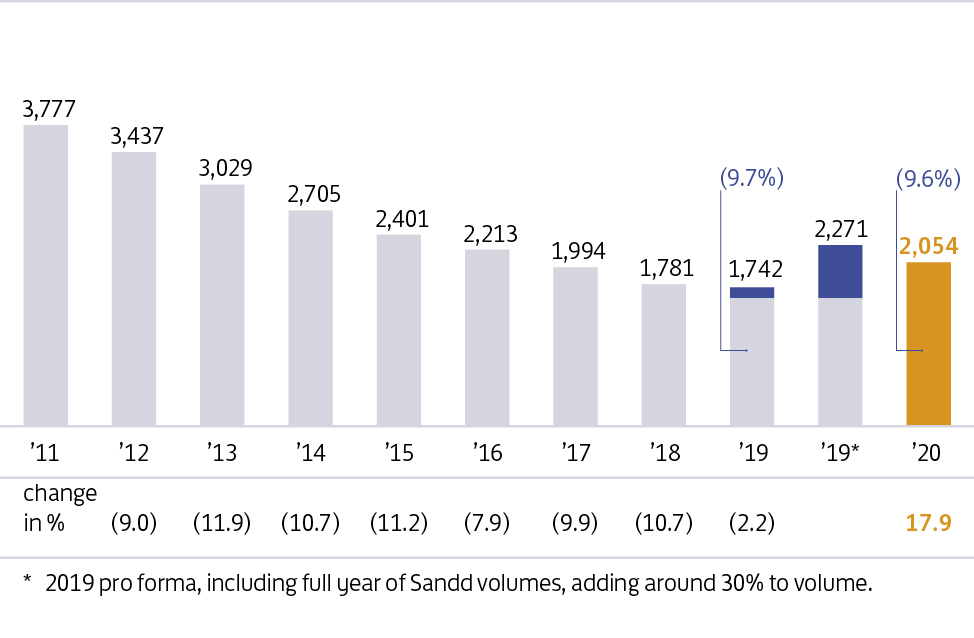

In 2020, performance at Mail in the Netherlands was marked by a stronger than expected decline in direct marketing and international volumes, mainly due to substitution but accelerated as a result of Covid-19, the impact of moderate price increases, more greeting and Christmas cards than expected, and the combination of mail networks. The latter contributed €49 million to normalised EBIT in 2020, of which €79 million synergies and €(30) million integration costs, and is ahead of plan in delivering the anticipated benefits and synergies.

The volume decline (compared with the pro-forma full year 2019 volumes of Sandd) of 9.6% was mainly driven by continuing substitution. Within the year, bulk mail volumes declined as direct mail campaigns were postponed, to recover only partly in the fourth quarter. At the same time, the Covid-19 crisis made people sent more greetings cards and gifts using letterbox parcels in both the first and second wave of the pandemic.

|

Revenue at Mail in the Netherlands was up 6.4% to €1,708 million (2019: €1,606 million) driven by the consolidation of Sandd (€116 million) and a volume decline impact of €(63) million, partly offset by price/mix effects of €59 million, the latter being supported by the temporary shift in product mix due to Covid-19 that is not expected to recur. Other revenue was down by €10 million.

Normalised EBIT significantly increased to €96 million (2019: €52 million), of which around €15 million is estimated to be non-recurring and related to Covid-19. The increase reflects the total volume and price/mix impact - a combined €112 million - partly offset by volume-related costs that were up €32 million. The increase in organic costs was €19 million. Other costs were up €1 million, and included integration costs of the mail networks and costs related to Covid-19, partly offset by cost savings and efficiency improvements. Other results were down €17 million, influenced by the disposal of non-core activities and the discontinued distribution of unaddressed mail.

PostNL continues to implement cost savings initiatives, such as adjustments to the sorting and delivery process, streamlining of staff and centralising of locations. The relatively high share of higher-margin single mail and parcel items in 2020/2021, in part driven by incidental Covid-19 impact, could have an impact on the level and phasing of regulated stamp price increases in the near future.

Revenue at PostNL Other amounted to €108 million (2019: €81 million). Normalised EBIT declined to €(60) million (2019: €(37) million), mainly as a result of higher pension expenses of around €25 million (an accounting impact only) as indicated earlier.

Pension expense amounted to €145 million (2019: €119 million) and total cash contributions were €311 million (2019: €144 million) or €111 million excluding the settlement payment of €200 million (2019: €111 million, excluding the unconditional funding obligation payment of €33 million). On 31 December 2020, the pension fund’s actual coverage ratio was 111.1%. The fund’s 12-month average coverage ratio was 104.4%, above the minimum required funding level of around 104.0%. Taking into account the resilience of the fund, no top-up payment obligation is expected.

Based on the financing agreement with the pension fund, the final payment for transitional plans at year-end 2020 was determined on parameters as in Q3 2019, when interest rates were very low. Taking into account the interests of all stakeholders, PostNL initiated discussions with the pension fund on options for a solution to smooth the impact of low interest rates in determining the final payment. In June, parties agreed on modified payment conditions.

The final payment now amounts to €280 million, of which PostNL had paid the pension fund €200 million at year-end 2020. The remaining €80 million will be deferred and paid in five annual instalments between 2021 and 2025. The agreement also led to reduced funding costs of soft pensions during 2020. In total, the reduction of the cash contribution for transitional plans amounted to around €20 million.

As of Q3 2018, following the decision to divest Nexive and Postcon, both business units are reported as ‘held for sale’ and the results and cash flows are reported as ‘discontinued operations’.

The sale of Postcon to Quantum Capital Partners was completed on 31 October 2019. The sale of 80% of the activities of Nexive to Mutares SE & Co KGaA was completed on 1 July 2020. PostNL obtained a minority interest of 20% in the entity acquiring the Nexive business. As part of the transaction, PostNL agreed to commit to a cash contribution.

In 2020, the result from discontinued operations of €4 million was €72 million better than in 2019.

This improvement is almost fully explained by the adjustments of €22 million in 2020 versus €(48) million in 2019, which resulted from the updated fair value assessment of the transactions with Mutares (Nexive) and Quantum Capital Partners (Postcon).

On 16 November 2020, PostNL and Mutares announced they reached an agreement with Poste Italiane to sell 100% of the activities of Nexive to Poste Italiane. The transaction has been completed on 29 January 2021.

For further details on our discontinued operations, see note 3.9 Assets classified as held for sale and note 5.5 Subsequent events to the consolidated financial statements.

Year ended at 31 December | 2019 | 2020 |

|---|---|---|

Revenue | 2,844 | 3,255 |

Operating income | 119 | 293 |

Profit for the period | 4 | 213 |

Profit from continuing operations | 72 | 209 |

Total comprehensive income | 3 | 237 |

Free cash flow | 107 | 186 |

Adjusted net debt | 736 | 407 |

Consolidated equity | (21) | 219 |

As of 2020, management analyses and reports on the Group 's profitability performance applying the key performance indicators revenue, normalised EBIT and free cash flow. Free cash flow gives a reflection of the Group's ability to generate cash available for acquisitions, debt repayments and/or dividend distributions. The repayments of leases, reported as cash used in financing activities following the adoption of IFRS 16, are as such included in our calculation of free cash flow.

On 5 November 2020, we agreed a €150 million sale-and-leaseback transaction on four mail sorting centres in the Netherlands, and the international sorting centre in The Hague. The sorting centers were sold to Urban Industrial, a Dutch company focused on the long-term exploitation of industrial real estate.

Nikaj van Hermon guided the process for PostNL. “Along with the sale we signed multi-year rental agreements with Urban Industrial for all locations, with lease terms varying between 5 and 10 years."

"The transaction strengthened our balance sheet and released value for the company, enabling us to accelerate the digitalisation of our company in a number of key areas as part of our ongoing transformation."

"In addition to the financial benefits, the transaction also gives us more flexibility to adapt to future volume decline within Mail in the Netherlands.”

Our free cash flow performance improved by €79 million to €186 million in 2020 (2019: €107 million). The performance was impacted by two material transactions: the net proceeds of €148 million from the sale-and-leaseback transaction, further explained in the story box, and the settlement payment of €200 million related to the transitional plans.

Our strong business performance and substantial growth in profitability of €110 million, together with a favourable working capital development of €44 million resulting from our strict working capital management, were the main contributors for the material increase in adjusted free cash flow. Slightly higher capital expenditures (€(12) million) and lease payments (€(17) million) were almost fully offset by lower taxes paid (€22 million).

Our aim is to generate a positive spread of the return on invested capital (ROIC) over the post-tax WACC (7.7% for the Group). The ROIC is based on reported operating income (less statutory tax). At the end of 2020, the ROIC for the Group was 17.2% (2019: 7.5%). The positive spread over the WACC in 2020 was +950 bps, which reflects the exceptional good performance in 2020.

The favourable effect of the book profit of the sale-and-leaseback transaction as well as the non-recurring impact of Covid-19 in 2020 explain a large part of the exceptional ROIC in 2020. However, if adjusted for large incidental and non-recurring effects, still a proper positive spread over the WACC would result.

The increase of the ROIC compared to 2019 is explained by an underlying improved business performance (reflected by the increase in normalised EBIT) and the above mentioned positive incidentals, partly offset by an increased level of invested capital due to higher lease liabilities and higher equity, partly offset by a large decrease of the pension liability.

At the end of 2020, our adjusted net debt position amounted to €407 million (2019: €736 million). The improvement of €329 million was fuelled by our strong performance on adjusted free cash flow and the net impact of the sale-and-leaseback transaction, which, taking into account the long-term lease arrangements related to this transaction, positively impacted the adjusted net debt position by €97 million at the transaction date. Refer to note 4.1 to the consolidated financial statements for further details on the develoment of our adjusted net debt position.

At 31 December | 2019 | 2020 |

|---|---|---|

Short- and long-term debt | 696 | 708 |

Long-term interest bearing assets | (6) | (27) |

Cash and cash equivalents | (480) | (651) |

Net debt | 210 | 31 |

Pension liabilities | 283 | 86 |

Lease liabilities (on balance) | 264 | 294 |

Lease liabilities (off balance) | 51 | 66 |

Deferred tax assets on pension and operational lease liabilities | (72) | (70) |

Adjusted net debt | 736 | 407 |

The combination of our step-up in profitability and better financial position benefited our leverage ratio, being adjusted net debt divided by adjusted EBITDA, which improved from 2.6 in 2019 to 1.0 in 2020, significantly below our target not to exceed 2.0.

Total equity attributable to equity holders of the parent company increased to €219 million at 31 December 2020 (2019: €(21) million). The increase of €240 million is mainly explained by the net income of €213 million in 2020 (2019: €4 million) and a €25 million positive impact from pensions, net of tax, recorded within other comprehensive income.

The increase in net income from €4 million in 2019 to €213 million in 2020 comprises a €137 million higher result from continuing operations and a €72 million higher result from discontinued operations. The book gain related to the sale-and-leaseback transaction, recorded within other income, contributed €60 million to the result from continuing operations. The strong improvement in net income increased the total earnings per share from 0.8 eurocents in 2019 to 43.0 eurocents in 2020.

At year-end 2020, PostNL's cash and cash equivalents amounted to €651 million (2019: €480 million) with current assets exceeding current liabilities.

Furthermore, PostNL has a €400 million committed revolving credit facility, which was fully undrawn at the end of 2020 (2019: undrawn). PostNL has no material refinancing of short-term credit facilities or other debt. There are no financial covenants. Our latest S&P credit rating is BBB with stable outlook. This underpins the solid financial performance and position of our company.