Our Board of Management takes strategic decisions throughout the year to help us realise our long-term objectives. This section outlines the main strategic decisions taken in 2019, and details some of the choices faced during the decision-making process. The Customer, Social, Environmental and Financial value chapters of the report provide a comprehensive overview of our strategy execution.

The continuing growth of the e-commerce market provides us with many business opportunities. We experience increased competition and cost consciousness among our customers. In 2019, the market grew at a slower pace than expected, which also impacted our projected volume growth. Our goal is to achieve a better balance between volumes, profitability and cash flow.

To create more leverage from parcels, we updated our strategy to increase revenues and reduce costs. Key elements in optimising our revenues are managing peaks in our networks, an updated pricing strategy based on both size and weight, and a greater focus on customer value through better insights. To better manage peaks, for example, we work with customers to find ways to reduce peak pressure, and we build seasonal variables into our pricing policy. We also focus on optimising our collection, transport and network control to increase efficiency and reduce costs. One example is the introduction of the small parcel sorting centre (SPSC) which we are currently developing. We are also working to enhance our digital interaction to improve first-time right delivery and reduce time spent per stop.

We have long argued that the consolidation of postal networks is vital to safeguard accessible, reliable and affordable postal services in the Netherlands. And to provide thousands of employees with greater job security, while ensuring that we retain our moderate pricing policy.

The consolidation will help cushion the decline of the postal market in a socially responsible way. All Sandd’s 11,000 postal deliverers have been offered jobs with PostNL, and around 4,000 of them accepted the offer and started working for us on 1 February 2020. From that moment on, a total of 20,000 postal deliverers will deliver millions of letters a day, five days a week. In addition, over 300 other employees from Sandd, working in sorting, as drivers and in other roles, will join us at either Mail or other entities. We will continue our collaboration with sheltered workplace companies, protecting 500 jobs for employees who face challenges in the labour market. And we also invested in a variety of other areas, such as job fairs, to help Sandd employees uncover new opportunities, with multiple companies from different sectors offering Sandd employees jobs.

We implemented the New mail route as planned in 2019, which will help us to reduce costs. Cost savings remain vital as we continue to deal with declining mail volumes. We chose to roll out the first phase of the New mail route implementation quickly to reduce the impact on employees, and we also invested heavily in employee training and communication before and during the roll out.

While we achieved strong cost savings during the first half of 2019, the integration of the Sandd and PostNL networks led to significant capacity changes, which caused some delays in other cost-saving initiatives in the second half of the year.

Our strategic focus is on our core markets in the Benelux, while supporting our transformation into an e-commerce logistic service provider. In 2019 we completed the sale of Postcon and PostNL Communication Services, and we made good progress with the divestment of Nexive. While the sale process of Postcon took longer than we had hoped, the goal was to find investors that we felt could support the businesses in their development. We believe the outcome justifies the time taken.

We continued to invest heavily in our infrastructure in the Netherlands in 2019, opening three new parcel sorting centres, further expanding our retail network, and adding additional self-service parcel lockers. We also began developing a small parcel sorting centre (SPSC), which is scheduled to open in 2021. The SPSC will enable us to sort small parcels more efficiently than our current sorting centres. The amount of volumes it will absorb, has the potential to save us from having to build up to five of our regular parcel sorting centres.

To strengthen our e-commerce position in Belgium, we invested in our own network of 350 parcel points across the country. We realised this in the last quarter of 2019, bringing our total number of parcel points to 447 by year end. The network will provide us with more options than collaborating with existing parcel points, and will help us to realise growth across the country.

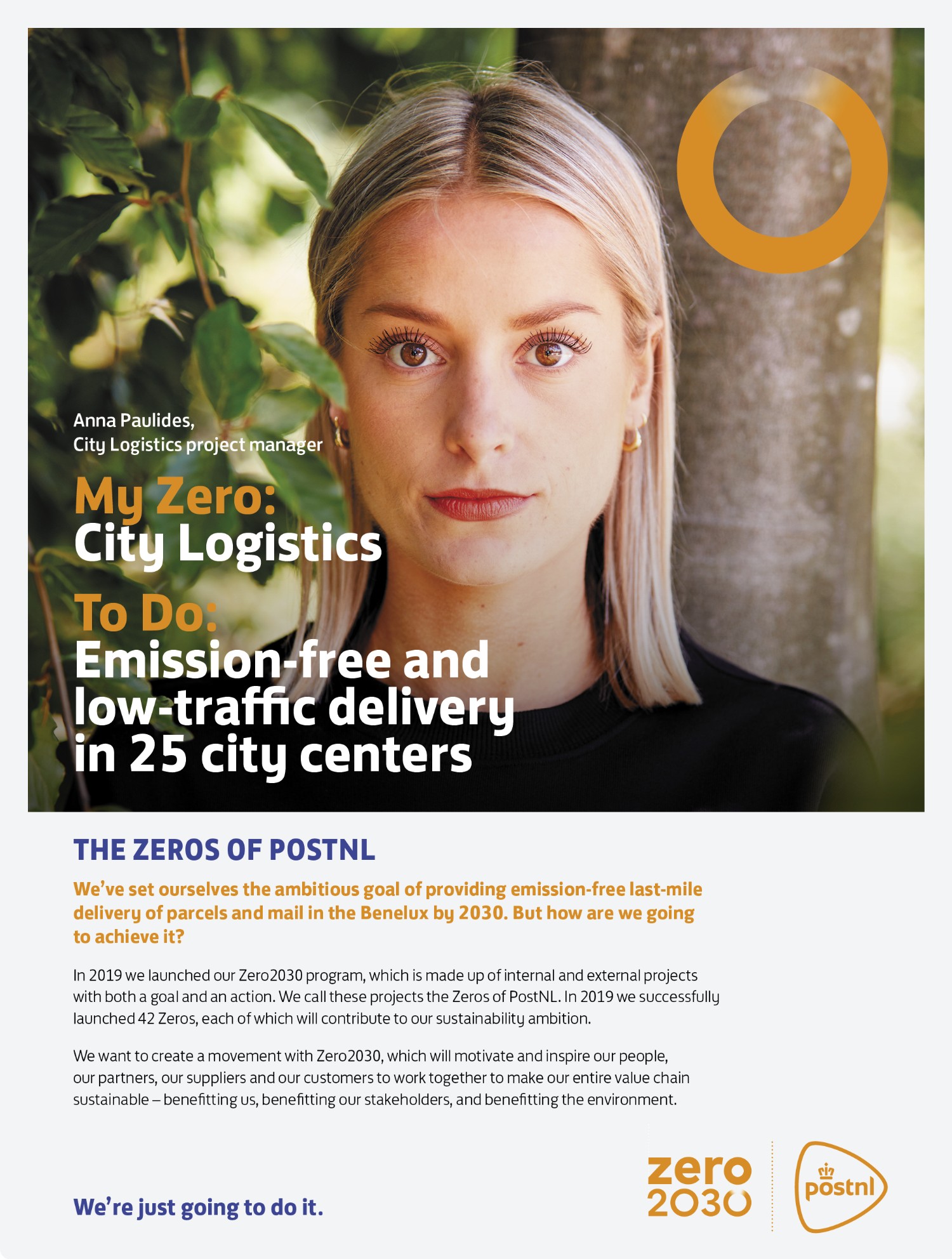

We have a set ourselves a number of ambitious environmental goals to combat climate change, including emission-free last-mile delivery in the Benelux by 2030. To help achieve this, in 2019 we issued a €300 million Green Bond.

We will use this bond to finance eligible green projects, including those covering green kilometres, sustainable buildings or innovation and efficiency. Initiatives such as the Green Bond is a powerful motivator for the company to take the next steps towards becoming a truly sustainable e-commerce logistics provider.

We carefully considered the green labelling of the bond during the process. As part of the external certification of our framework, we wanted to ensure those projects supporting our bond are eligible. Another important element in our decision was the alignment of the proceeds with our long-term investment strategy.

We look to develop alternative growth domains which are related to our core logistic propositions to create and develop future opportunities. In 2019 this involved continuing to explore options in two key growth markets: health and food.

We collaborate closely with small innovative companies to explore new propositions. PostNL adds value by bringing our expertise to challenge new ideas and help small companies to prepare and grow their business cases. Also, our strong brand helps open doors with investors or other stakeholders to pitch ideas to the market. This helps with finding pilot customers or partners to test ideas and bring business cases to the next level. We also chose to shut down our Stockon activities, which was heavily reliant on marketing and fulfilment in a competitive market.

We consider relevant opportunities and risks in our strategy execution. In the remainder of the business report we detail the main opportunities we pursued in 2019. Our response to the main risks can be found in the chapter 'Risk management'.