In this section we explain the main drivers behind our financial performance on revenue, underlying (cash) operating income and other financial indicators in 2019, beginning with a summary of the key financials on the acquisition of Sandd.

On 22 October 2019, PostNL acquired 100% of the shares of Sandd, the other postal company with country-wide coverage in the Netherlands, for an amount of €65 million. After the acquisition was closed, an amount of €64 million was paid to repay debts. The acquisition fits with our goal to create a country-wide postal network in the Netherlands, to ensure that the postal market remains reliable, accessible and affordable for everyone.

The purchase price allocation resulted in intangible assets of €30 million (customer relationships, with an amortisation period of 16 years) and goodwill of €128 million. The goodwill comprises the value of expected synergies arising from the acquisition.

In 2019, Sandd’s total revenue and net income since the acquisition date amounted to €39 million and €(54) million respectively. The recording of a restructuring provision of €24 million and the accelerated depreciation of assets for €25 million had a substantial negative impact on Sandd's result. These costs have been excluded from our review of Sandd's underlying (cash) operating income performance.

In 2019, Group revenue increased by 2.6% or €72 million to €2,844 million (2018: €2,772 million). We achieved our target to generate more than 50% of our revenue from e-commerce related activities by 2020 one year ahead of plan. This share grew from 48% in 2018 to 52% in 2019. The pace of our transformation was slowed slightly by lower than expected e-commerce growth and a lower decline in mail volumes as a result of the acquired volumes and revenue of Sandd in Q4 2019.

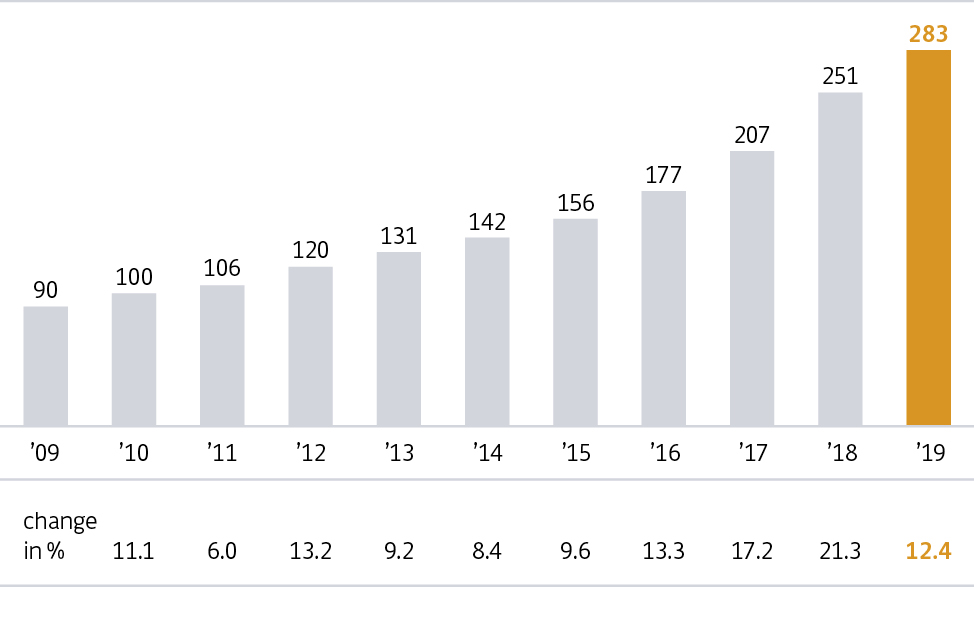

We delivered 283 million parcels in the Benelux in 2019, a 12.4% growth compared to 2018 (2018: 252 million). Although this growth rate is still significant, compared to the last two years the pace of e-commerce growth has slowed. This is mainly explained by a decrease in e-commerce growth in more mature segments and lower consumer confidence. Additionally, we were impacted by multi-vendorship at large webshops. Due to the expansion of our network capacity, we managed to collect, sort and deliver record volumes in our peak season towards the end of the year.

Revenue at Parcels (excluding Spring) grew by €120 million to €1,450 million in 2019 (2018: €1,330 million). Fuelled by the volume growth of 12.4%, the 9.0% growth in revenue was impacted by a negative price/mix effect. In May, we announced our strategic focus on improving margins per parcel, by increasing the revenue per parcel and decreasing the costs per parcel. We began implementing this strategy during the second half of 2019, and expect to see tangible results during the course of 2020. In 2019, we also benefitted from an increase in demand for our tailored value-adding logistic solutions.

At Spring, revenue increased by 1.5% or €4 million to €263 million (2018: €259 million). Adjusted for FX effects, revenue declined by 1.4%. The competitive environment remains fierce, especially in Asia.

Total revenue at Parcels, including Spring, increased by 7.5% or €117 million to €1,672 million (2018: €1,555 million).

|

|

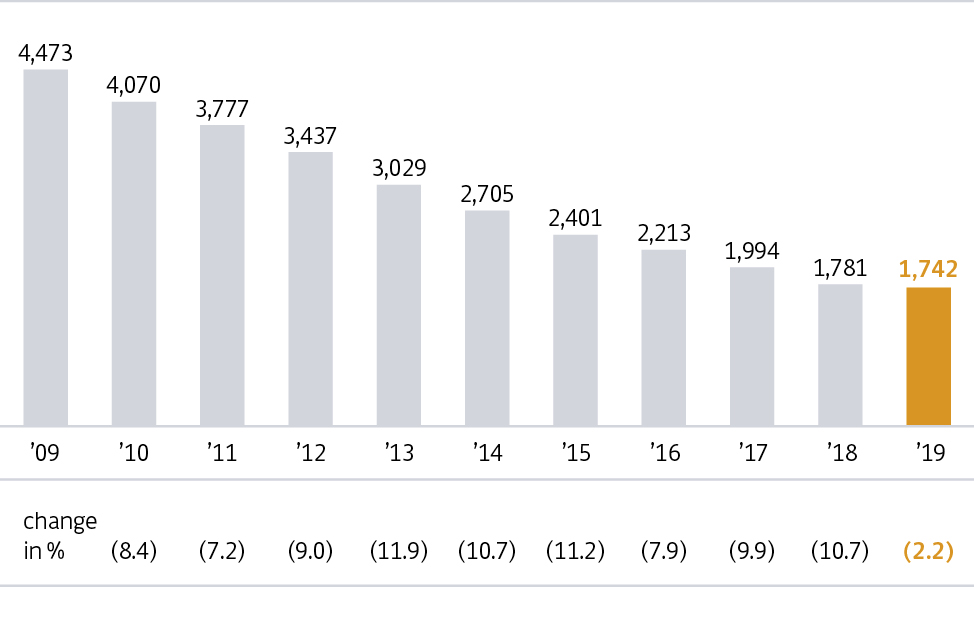

At Mail in the Netherlands, volume decline (excluding the acquired volumes of Sandd) was 9.7% (2018: 10.7% decline). The volume decline was driven by ongoing substitution, loss to competition due to reduced network access and loss of volumes to competition. Including the volumes of Sandd from the acquisition date, total volumes decreased by 2.2% in 2019.

In 2019, revenue decreased by 4.3% or €72 million to €1,606 million (2018: €1,678 million), with the volume decline during the first ten months of 2019 (before the acquisition of Sandd) only partly compensated by a positive price/mix effect. In addition to income from our core addressed mail volumes, revenue also includes income from related business activities. These other activities include the delivery of unaddressed mail and customer contact, print and direct marketing services.

In 2019, the Group’s underlying operating income was €162 million (2018: €209 million) with a resulting margin of 5.7% (2018: 7.5%). Underlying operating income excludes exceptional items, which amounted to €43 million in 2019 (2018: €24 million). The Group’s underlying cash operating income, in which underlying operating income is adjusted for non-cash costs of pensions and provisions, was €176 million (2018: €188 million) with a resulting margin of 6.2% (2018: 6.8%). As expected, this was negatively impacted by integration costs related to Sandd.

Further information on the bridge from operating to underlying (cash) operating income is included in note 2.5 to the consolidated financial statements.

Our Parcels segment (excluding Spring) benefitted from strong volume growth in 2019. New initiatives, such as the introduction of a single delivery attempt, and more evening, Sunday and same-day delivery contributed to this better performance. The strong volume growth was partly offset by a negative price/mix effect and higher operational costs, explained by the tight labour and transport market and capacity costs to absorb the swings in daily volume.

In 2019, underlying operating income at Parcels, including Spring, was €122 million (2018: €121 million) with a resulting margin of 7.3% (2018: 7.8%). Underlying cash operating income in 2019 was €121 million (2018: €117 million) with a resulting margin of 7.2% (2018: 7.5%).

Mail in the Netherlands performance in 2019 was below 2018. Lower volumes were only partly compensated by a positive price/mix effect, negatively impacting revenue. This impact could not be fully countered by lower costs. Cost savings, higher results from export and lower cash out related to pensions and provisions were offset by autonomous cost increases and other effects.

Our cost saving plans include a number of initiatives, such as adjusting our sorting and delivery process and the streamlining of staff. In 2019, we achieved total cost savings of €48 million, which, as expected, were at the lower end of our guidance of between €45 million and €65 million.

In 2019, the underlying operating income of Mail in the Netherlands was €77 million (2018: €133 million) with a resulting margin of 4.8% (2018: 7.9%). Underlying cash operating income in 2019 was €76 million (2018: €93 million) with a resulting margin of 4.7% (2018: 5.5%).

As of 2020, management will analyse and report on the Group 's profitability performance applying the key performance indicators normalised EBIT and free cash flow (as replacements to UCOI and net cash from operating and investing activities). Normalised EBIT gives a reflection of the Group's operating income performance, in which one-off and significant non-business related items are excluded and explained.

In 2019, the Group's normalised EBIT amounted to €135 million, with Parcels, Mail in the Netherlands and PostNL Other contributing €120 million, €52 million and €(37) million respectively. The normalisations in normalised EBIT for 2019 are equal to the underlying items in UCOI for 2019, with the exception of restructuring-related charges.