In 2022 PostNL saw a strong reduction in volume growth within Parcels, which was to some degree an expected post-Covid impact. We also experienced a sharp increase in organic costs. Both outcomes are strongly connected to the ongoing geopolitical turbulence, which is creating macroeconomic uncertainty, depressed consumer trust and spending, and high levels of inflation.

At the beginning of the year we prepared ourselves for further growth, which was the expectation for 2022. However, as a result of unexpected external factors, this growth did not materialise, leading to an overcapacity in the delivery market. We also had to absorb strong cost increases, as a result of price agreements that had already been agreed with our customers for 2022.

In response to these developments, we implemented a number of measures to reduce operational costs within Parcels, improving the operational efficiency of the business compared to 2021. Across the rest of the company, we undertook additional cost reduction measures and introduced price surcharges where possible. Despite our best efforts, we were unable to counter the impact of lower volumes and higher organic costs.

The labour market in the Netherlands further tightened in 2022, illustrated by low unemployment rates and a record number of open vacancies. This made it more difficult for PostNL to recruit in some regions, with Mail in the Netherlands particularly badly affected. This added to the pressure on wages, which were also affected by rising inflation, and impacted delivery quality levels.

Turbulent market circumstances saw volumes at Parcels come under pressure, due in part to overcapacity in the market leading to price pressure and some market share loss, and well below expectations. Underlying domestic parcel volumes in 2022 increased by 2.3% compared to 2021.

Volumes at Mail in the Netherlands developed in line with expectations. We continued to deliver millions of parcels, letters and special moments during the peak season, once again demonstrating the strength of our execution capabilities and operational processes.

The turbulent economic environment contributed to lower revenue of €3,144 million and a step-down in normalised EBIT at €84 million, which was also impacted by a sharp increase in labour and fuel costs. The resulting free cash flow of €40 million reflected the drop in normalised EBIT and negative working capital phasing.

Our adjusted net debt amounted to €467 million at year end. The increase of €264 million was largely influenced by the cash flow related to the share buyback programme we announced at the beginning of 2022, and the dividend payments, totalling €329 million, for the year. With reference to a later section on pensions, our adjusted net debt benefited by €20 million from the pension agreement made in 2022.

The combination of reduced profitability and a less strong financial position brought our leverage ratio, adjusted net debt divided by adjusted EBITDA, to 1.9 in 2022, below our target to not exceed 2.0. Based on our dividend policy, we propose a full year 2022 dividend of €0.16 per share.

While PostNL is taking all necessary adaptive measures and focusing on strict cost control in the short term, its strategic aims remain unchanged. This includes remaining focused on generating profitable growth and sustainable cash flow.

We aim to capture value through smart yield management, for example by driving value through smart services and delivery options, enhancing pricing strategies based on data and insights, and balance volumes and value for effective margin management. And we continue to invest in the performance of our operations, both in terms of network capacity, synergies and digitalisation, while enhancing cost efficiency and delivering high-quality services.

We continue to aim to provide short- and long-term financial value for our financial stakeholders, enabling them to obtain an attractive return. In this section we present and explain the 2022 performance of the Group, and thereafter of our operating segments Parcels and Mail in the Netherlands.

PostNL applies the key performance indicators (KPIs) of revenue, normalised EBIT and free cash flow in its management analyses and reports on profitability performance. Normalised EBIT gives a reflection of the operating income performance, adjusted for the impact of project costs and incidentals. Free cash flow gives a reflection of the Group's ability to generate cash available for acquisitions, dividend distributions and/or debt repayments.

Normalised EBIT and free cash flow represent non-GAAP financial measures and should not be viewed in isolation as alternatives to the equivalent IFRS measures, which are presented in the consolidated financial statements, but should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have a standardised meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers.

In 2022, revenue decreased by 9.3% to €3,144 million (2021: €3,466 million), showing the negative impact of the global macroeconomic and geopolitical environment at Parcels, the impact of the ongoing volume decline within Mail in the Netherlands and the absence of the positive impact from non-recurring Covid-19-related items in 2021. In 2022, 61% of our revenue was generated from e-commerce-related activities (2021: 61%).

Download spreadsheetRevenue | Normalised EBIT1 | |||

|---|---|---|---|---|

Year ended at 31 December | 2021 | 2022 | 2021 | 2022 |

Parcels | 2,361 | 2,165 | 230 | 56 |

Mail in the Netherlands | 1,683 | 1,495 | 160 | 107 |

PostNL Other | 200 | 215 | (81) | (80) |

Intercompany | (777) | (731) | ||

PostNL | 3,466 | 3,144 | 308 | 84 |

In 2022, normalised EBIT amounted to €84 million (2021: €308 million). The resulting margin, being normalised EBIT divided by total operating revenue, was 2.7% in 2022 (2021: 8.9%).

Compared to 2021, normalised EBIT decreased by €225 million in 2022. Of this, around €80 million was related to a lower non-recurring Covid-19 result, where we estimate a benefit of only €2 million in 2022 (€(2) million at Parcels and €5 million at Mail in the Netherlands) versus €82 million in 2021 (€40 million at Parcels and €42 million at Mail in the Netherlands). The remaining decrease of €145 million was mainly caused by a strong reduction in parcel volume growth and a high increase in organic costs, only partly compensated by positive developments in operational costs and pricing measures.

Normalised EBIT excludes exceptional items, which amounted to €(1,375) million in 2022 (2021: €15 million). The main part of this normalisation is caused by the accounting impact of the amended pension plan of €(1,357) million, which we explain in more detail in a later section of this chapter. Further information on the bridge from operating income to normalised EBIT can be found in 'Note 2.7 Segment information'

Our Parcels services range from delivering standard parcels to more tailored solutions, such as health logistics, and from time-critical delivery to installation services. E-commerce is shaping the future of retail, and we help drive this vital sector through IT, network and infrastructure investments, such as processing small parcels. At the same time, our digital platforms enable us to offer e-tailers and consumers greater control over sending and delivery. Together, these factors enable us to focus on optimising our revenues while creating greater customer value through better insights.

Within logistics, we have chosen to develop a strong position in the health sector while broadening and strengthening the e-commerce logistics chain. For example, we help e-tailers grow online by supplying fulfilment solutions and we offer customers time-critical services. We provide customers with international delivery solutions through Spring, a provider of global e-commerce solutions. Spring is also providing customers with more options in logistics solutions.

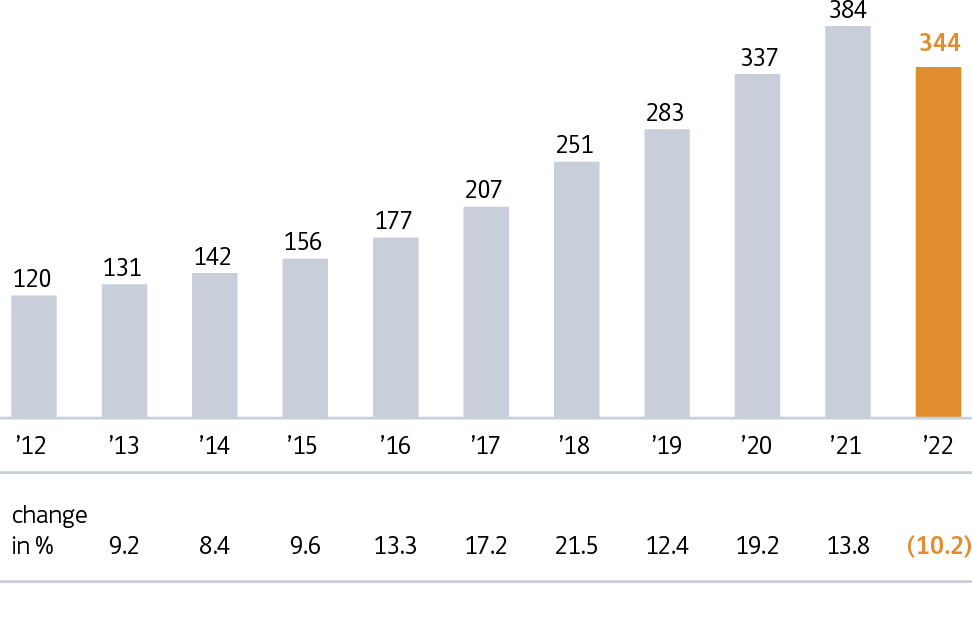

In 2022, we delivered 344 million parcels, of which we estimate around 2 million to be non-recurring and related to Covid-19 (2021: 38 million). This resulted in a reported volume decline of (10.2)% compared to 2021. The impact from non-recurring volumes related to Covid-19 was (9.5)%. The drop in international volumes following the change in VAT regulation, global supply chain disruptions, and zero Covid-19 policy in China contributed (3.0)% negatively. Excluding these effects, the underlying domestic volumes in 2022 increased by 2.3% compared to 2021.

Download spreadsheet |

Revenue at Parcels decreased to €2,165 million (2021: €2,361 million). The impact of the strong volume decline clearly showed in our domestic and international parcel delivery, but was also visible in our Spring and Logistics business lines.

Normalised EBIT decreased by €174 million, from €230 million in 2021 to €56 million in 2022, driven by a (10.2)% volume decrease. The volume decline resulted in €(162) million less revenue, partly offset by a positive price/mix effect of €30 million and lower volume dependent costs of €98 million, and impacted normalised EBIT negatively by €35 million.

Organic costs increased by €74 million due to collective labour agreement increases, indexation of delivery partners, and higher fuel costs. Other costs decreased by €12 million, mainly caused by lower operational costs due to higher efficiency and lower stop costs, partially offset by higher network costs and sick leave.

The other results were down €(77) million, mainly caused by lower results at Spring and Logistics, including a lower non-recurring Covid-19 impact, higher (international) transport costs, and lower results in Belgium.

In the Netherlands, we offer senders and receivers a range of postal services. We focus on strengthening the value of mail and enhancing the customer experience. We are managing the ongoing volume decline through price adjustments and reducing costs in the organisation by optimising and digitalising our processes, enabling us to deliver stable and predictable normalised EBIT and cash flow.

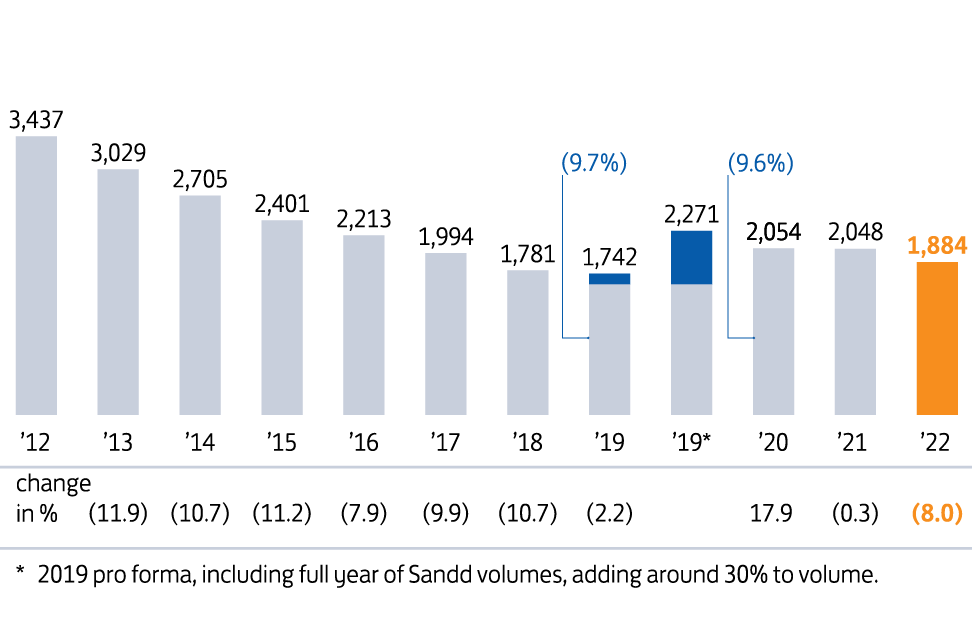

In 2022, we delivered 1,884 million items of mail, of which we estimate around 30 million to be non-recurring and related to Covid-19 (2021: 67 million). This resulted in a reported volume decline of (8.0)% compared to 2021. The underlying domestic and international volumes in 2022, excluding the impact from non-recurring volumes related to Covid-19 of (1.6)%, decreased by 6.4% compared to 2021.

Download spreadsheet |

Revenue at Mail in the Netherlands decreased to €1,495 million (2021: €1,683 million), mainly showing the impact of the ongoing volume decline and less non-recurring and Covid-19-related volumes in 2022 compared to 2021. The negative volume and price/mix impact on the result of Mail in the Netherlands amounted to €(85) million.

Normalised EBIT decreased by €53 million to €107 million (2021: €160 million). The net volume price/mix effect of €(85) million was partly offset by lower volume-dependent costs of €30 million. Organic costs increased by €35 million mainly due to collective labour agreement increases and inflation.

Other costs decreased by €47 million, which for a large part is explained by additional cost savings and efficiency improvements of €27 million, release of provisions, and higher bilateral results. Other results were down €10 million, mainly influenced by a lower result from services and lower export volumes.

We are continually adapting our Mail in the Netherlands organisation and business model to the ongoing market decline, such as adjustments to the sorting and delivery process, streamlining of staff and centralising of locations, to realising the necessary cost savings to keep mail affordable while generating sustainable cash flows.

Revenue at PostNL Other in 2022 amounted to €215 million (2021: €200 million). This revenue is mainly inter-company revenue related to IT. Normalised EBIT of €(80) million was more or less in line (2021: €(81) million).

Based on a joint decision by PostNL, the pension fund and the trade unions, taken on 23 December 2022, PostNL’s pension plan was amended from 31 December 2022. One particularly relevant amendment saw the removal of the former annual indexation cap of 4%, meaning that, combined with the solid financial position of the pension fund, it was possible to increase pensions by 10% from 1 January 2023. This amendment directly benefited the (future) purchasing power of all pension fund participants.

As part of the adjustment, the pension plan is now based on a collective defined contribution plan. This means that, among other impacts, PostNL will only be required to pay the regular pension contribution, as the agreement for top-up payments and restitution has been cancelled. This means that if the financial position of the pension fund deteriorates, PostNL is no longer obliged to make top-up payments. At the same time, PostNL is also no longer entitled to restitutions, even if the financial position of the pension fund would allow for that.

The parties involved also agreed on the implementation of the new pension law regulation, which is expected to come into effect in the course of 2023 and will mandate the transition to a new pension contract by 1 January 2027 at the latest. They agreed on a preferred contract that includes a contribution plan based on solidarity, and intend to transfer the accrued pensions into the new system. The transition will be accomplished entirely from the pension fund assets, with no financial contribution or compensation from PostNL.

Finally, as part of the agreement, the unconditional funding obligation has also been adjusted. The adjustment concerns a reduction of €20 million and an amended payment schedule (2022: €28 million; 2023: €16 million). On balance, this has resulted in an improvement in PostNL’s adjusted net debt position of €20 million at year-end 2022.

“The amended pension plan made it possible to increase pensions by 10%, directly benefiting all participants”

The accounting consequence of the amended pension plan is a change from defined benefit accounting to defined contribution accounting per 31 December 2022. The settlement result as recorded in the statement of profit or loss comprises the release of the positive funded status and the reduction of the unconditional funding obligation. As a separate sequential step, the recorded asset ceiling adjustment is reversed within other comprehensive income.

The financial impact of the change in pension accounting classification is material, being a loss of €1,357 million (net loss: €1,007 million) recorded in the statement of profit or loss, comprising a defined benefit pension expense of €1,354 million and an addition to other provisions of €3 million, and a net defined benefit pension income of €1,020 million recorded in other comprehensive income. Both impacts were normalised in our key financial indicators, normalised EBIT and normalised comprehensive income, in 2022.

In 2022, excluding the impact from the change in pension accounting classification, total employer pension costs amounted to €172 million (2021: €161 million). Total employer cash contributions in 2022, excluding the instalment of the unconditional funding obligation of €28 million (2021: €16 million), were €97 million (2021: €92 million).

Following the change towards a collective defined contribution plan, according to IFRS pension expenses will equal the contribution paid by PostNL to the pension fund as of 31 December 2022. In 2022 regular pension expenses were substantially higher than the paid contributions. Following the adjustment of the pension plan, this gap will disappear as of 2023. As a consequence, pension expenses will be substantially lower.

“The current and future financial impact of the change from defined benefit to defined contribution pension accounting is material”

In respect of the collective defined contribution plan, a fixed premium calculation methodology (including assumptions used) applies for fixed periods of 5 years. Only in the case of obligatory adjustments, for example on the regulated maximum allowed expected return on equities, might the assumptions used need to change. On the basis of current facts and circumstances, the ex-ante expected total pension cash contribution rate will equal 29.2% for the upcoming fixed period (until the transition to the anticipated new pension contract).

On 31 December 2022, the pension fund’s actual coverage ratio was 130.6% (2021: 126.2%). The fund’s 12-month average coverage ratio was 134.8% (2021: 121.4%). The increase in coverage ratio is mainly explained by the positive effect on plan liabilities resulting from an increase of the interest rate, partly offset by a negative return on plan assets and the impact of the decision to increase pensions by 10% per 1 January 2023.

See note '3.5 Provisions for pension liabilities'

In 2022, the net financial expense amounted to €19 million (2021: €21 million). The net decrease was caused by €2 million higher interest income (2022: €3 million; 2021: €1 million). Within expenses, the increase in interest on the net defined benefit pension liabilities and leases of €3 million in total was fully offset by lower financial expenses on various others.

In 2022, the income tax expense (excluding the tax effect on the change in pension accounting classification) amounted to €21 million (2021: €74 million). The €53 million decrease was due mainly to the material reduction in business performance and the impact of the de-recognition of previously recognised tax losses in various countries.

Download spreadsheetYear ended at 31 December | 2021 | 2022 |

|---|---|---|

Revenue | 3,466 | 3,144 |

Operating income1 | 324 | 66 |

Profit for the period1 | 258 | 14 |

Profit from continuing operations1 | 228 | 26 |

Total comprehensive income1 | 325 | 66 |

Free cash flow | 288 | 40 |

Return on invested capital1 | 16.4% | 4.1% |

Adjusted net debt | 203 | 467 |

Consolidated equity | 426 | 177 |

In 2022, the profit from continuing operations (excluding the impact of the change in pension accounting classification) amounted to €26 million (2021: €228 million). The material decline of €202 million in net bottom-line performance highlights the severe impact the ongoing turbulent geopolitical and macroeconomic circumstances, which led to reduced consumer spending and high levels of labour and fuel inflation, have had on our net business performance.

In 2022, the result from discontinued operations was €(11) million (2021: €29 million). This result mainly reflected the financial impact related to a settlement reached between PostNL and the Italian tax authorities. The settlement resolved an ongoing VAT dispute. The financial impact includes a payment due to the Italian tax authorities of €30 million partially offset by management's best estimate of the collectability of the related imputed VAT receivables from former customers of €16 million and a positive income tax effect of €3 million. No cash impact was yet visible in 2022. For further details on discontinued operations see note '2.4.3 Profit /(loss) from discontinued operations'

We aim to prioritise capital allocation based on a sound financial framework, taking into account developments in our results, return on invested capital and cash conversion, to fund further growth and provide sustainable shareholder returns. Throughout the year we continued to invest in our business and digital transformation to strengthen our competitive position.

Free cash flow is defined as cash flow before dividend, acquisitions, redemptions of bonds and other financing activities, and after payment of leases. The repayment of leases and related cash flows, reported as cash used in financing activities following the adoption of IFRS 16, are as such included in our calculation of free cash flow.

Our free cash flow decreased by €248 million to €40 million in 2022 (2021: €288 million). This decline is mainly caused by the materially lower business performance, less favourable working capital development, a higher pension instalment and the non-recurring proceeds from the sale of Cendris in 2021, only partly compensated by substantially lower income tax payments in 2022 compared to 2021.

In 2022, PostNL executed the first tranche of the share buyback programme, which was announced at the beginning of 2022 with a total value of maximum €250 million to neutralise the assumed dilutive impact of shares issued in relation to dividends over 2021-2023. The company has repurchased the maximum number of 51 million ordinary shares for a total consideration of €164 million.

A second tranche of the programme, scheduled to be executed during 2023, will be delayed until further recovery of business performance and in accordance with PostNL’s capital allocation framework. The company aims at a leverage ratio (adjusted net debt/EBITDA) not exceeding 2.0.

Our aim is to generate a positive spread of the return on invested capital (ROIC) over the post-tax WACC (8.0% for the Group). PostNL defines ROIC as net operating profit less adjusted tax (NOPLAT) divided by invested capital. At the end of 2022, the ROIC for the Group was 4.1% (2021: 16.4%). The negative spread over the WACC in 2022 was (390) basis points. The ROIC was negatively impacted by a lower business performance, partly compensated by the positive impact of the share buyback program.

Download spreadsheetYear ended at 31 December | 2021 | 2022 |

|---|---|---|

Operating income1 | 324 | 66 |

Less adjusted tax | (81) | (17) |

Net operating profit less adjusted tax (NOPLAT) | 243 | 49 |

Total equity | 429 | 179 |

Adjusted net debt | 203 | 467 |

Add back cash and cash equivalents | 848 | 556 |

Invested capital | 1,480 | 1,202 |

Return on invested capital (ROIC) | 16.4% | 4.1% |

The favourable effect of the non-recurring impact of Covid-19 in 2021 largely explains the exceptional ROIC in that year. However, if adjusted for large incidental and non-recurring effects, we would have seen a positive spread over the WACC in 2021.

At the end of 2022, our adjusted net debt position amounted to €467 million (2021: €203 million). The increase of €264 million mainly resulted from the cash flow related to the first tranche of the share buyback of €164 million and dividend payments of €165 million. See note '4.1 Adjusted net debt'

At 31 December | 2021 | 2022 |

|---|---|---|

Short- and long-term debt | 732 | 745 |

Long-term interest bearing assets | (20) | (17) |

Cash and cash equivalents | (848) | (556) |

Net debt | (136) | 172 |

Pension liabilities | 67 | 18 |

Lease liabilities (on balance) | 333 | 331 |

Lease liabilities (off balance)1 | 17 | 29 |

Deferred tax assets on lease liabilities2 | (79) | (83) |

Adjusted net debt | 203 | 467 |

The combination of our fall in profitability and reduced financial position negatively impacted our leverage ratio, being adjusted net debt divided by adjusted EBITDA, which increased from 0.4 in 2021 to 1.9 in 2022, below our target to not exceed 2.0.

Download spreadsheetYear ended at 31 December | 2021 | 2022 |

|---|---|---|

Adjusted net debt | 203 | 467 |

Operating income1 | 324 | 66 |

Depreciation, amortisation and impairments | 149 | 156 |

Proxy for short-term leases and leases of low-value assets | 4 | 4 |

Normalisations on EBIT1 | (15) | 17 |

Reversal of normalised depreciation, amortisation and impairments | (0) | (0) |

Adjusted EBITDA | 461 | 243 |

Leverage ratio | 0.4 | 1.9 |

Total equity attributable to equity holders of the parent company declined to €177 million at 31 December 2022 (2021: €426 million).

The decrease of €249 million in 2022 is mainly explained by the first tranche of the share buyback of €164 million and dividend payments of €165 million, partly offset by the positive impact from pensions (excluding the impact of the change in pension accounting classification) recorded within other comprehensive income.

At year-end 2022, PostNL's cash and cash equivalents amounted to €556 million (2021: €848 million) with current assets exceeding current liabilities.

PostNL has a €200 million revolving credit facility in place. With the facility, PostNL secures the availability of future financing at updated terms and lower costs, in line with its financial policy. PostNL wants to be the driver of sustainable logistics in the Benelux. Therefore, the margin PostNL pays is partly dependent on the successful execution of its emission-reduction strategy.

PostNL has no material refinancing of short-term credit facilities or other debt. There are no financial covenants. Our current S&P Global Ratings credit rating is BBB with negative outlook.

On 19 January 2023, PostNL announced that an agreement had been reached with the trade unions BVPP and CNV on a new collective labour agreement (CLA) for PostNL and one for Saturday deliverers. The agreements specify a total wage increase of up to 9.5% over two years. All payment components related to 2022 have been expensed in 2022. In addition, in February 2023, PostNL will make a one-time payment of 1.5% of annual salary. Both CLAs are effective as of 1 April 2022 and end on 31 March 2024.

In accordance with our dividend policy, PostNL aims to pay a dividend that develops substantially in line with operational performance. The dividend pay-out ratio will be around 70% to 90% of normalised comprehensive income. PostNL defines normalised comprehensive income as comprehensive income normalised for incidentals in operating income/EBIT, net of statutory tax, as well as the net result from discontinued operations. In 2022, PostNL's normalised comprehensive income amounted to €90 million (2021: €285 million).

Download spreadsheetYear ended at 31 December | 2021 | 2022 |

|---|---|---|

Profit for the year1 | 258 | 14 |

Other comprehensive income1 | 68 | 52 |

Comprehensive income | 325 | 66 |

Normalisations on EBIT (less statutory tax)1 | (12) | 13 |

Normalise result from discontinued operations | (29) | 11 |

Normalised comprehensive income | 285 | 90 |

Our dividend policy states that dividend distribution is conditional on being properly financed in accordance with our financial framework. PostNL is steering for a solid balance sheet with a positive consolidated equity, aiming at a leverage ratio not exceeding 2.0 and applying strict cash flow management. This condition was met at the end of 2022. As a result, PostNL will recommend to the Annual General Meeting of Shareholders a pay-out of 85% of normalised comprehensive income for 2022, being a dividend of €0.16 per ordinary share (2021: €0.42). €0.14 was paid as an interim dividend, so the final dividend to be paid in May 2022 will be €0.02 per share. This will be proposed to the Annual General Meeting of Shareholders.

2022 | |

|---|---|

Result attributable to the shareholders | (2,383) |

Appropriation in accordance with the articles of association: | |

Reserves withdrawn by the Board of Management and approved by the Supervisory Board (article 31, paragraph 2) | 2,443 |

Dividend on ordinary shares | 60 |

(Interim) dividend paid in cash | (50) |

Final dividend | 10 |