Ordinary shares in PostNL N.V. (ticker: PNL, ISIN code 0009739416) are listed on Euronext Amsterdam and included in the AMX index. Options on PostNL shares are traded on Euronext Derivatives Amsterdam and on the European Options Exchange in Amsterdam.

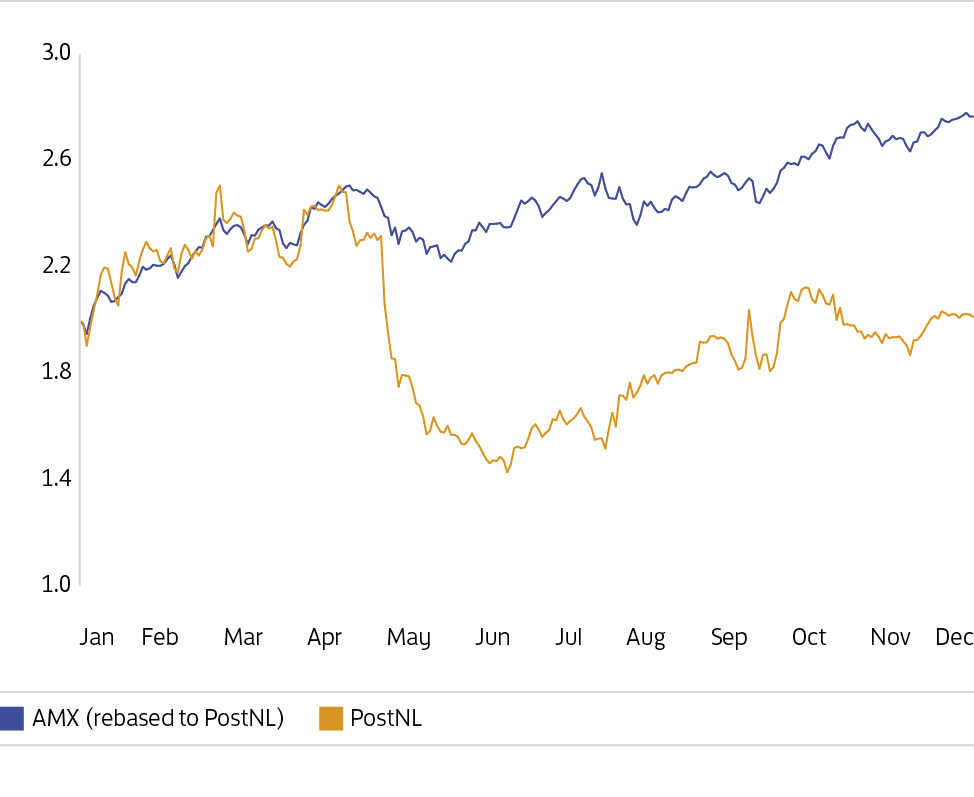

In 2019, 1,378 million PostNL shares were traded on Euronext Amsterdam (2018: 1,048 million). The average daily number of shares traded was 5.3 million (2018: 4.1 million). The market capitalisation of PostNL was €946 million at the end of 2019 (2018: €937 million).

|

PostNL’s authorised share capital is divided into 1,500,000,000 shares of €0.08 each and consists of 750,000,000 ordinary shares and 750,000,000 preference shares B. The number of issued and outstanding ordinary shares was 493,952,586 on 31 December 2019 (2018: 469,199,776 shares). All shares in issue are fully paid. In 2019, 23,900,149 shares were issued as stock dividend (2018: 15,165,535) and 852,661 for the share plan for employees (2018: 504,046). No preference shares B were issued and outstanding. For more information on PostNL’s equity, see note 4.6 to the consolidated financial statements.

Pursuant to the Financial Markets Supervision Act (Wet op het financieel toezicht), shareholders must disclose percentage holdings in the capital and/or voting rights in the company when such holding reaches, exceeds or falls below 3%, 5%, 10%, 15%, 20%, 25%, 30%, 40%, 50%, 60%, 75% and 95%.

Such disclosure must be made to the Dutch Financial Markets Authority (AFM) without delay. Our substantial shareholders are listed in the table below.

Date of notification | Company | (Indirect and/or potential) Holding | Holding of (indirect and/or potential) voting rights |

|---|---|---|---|

16 December 2019 | Norges Bank | 3.08% | 3.08% |

29 November 2019 | Edinburgh Partners | 4.17% | 4.17% |

12 November 2015 | J.H.H. de Mol | 5.04% | 5.04% |

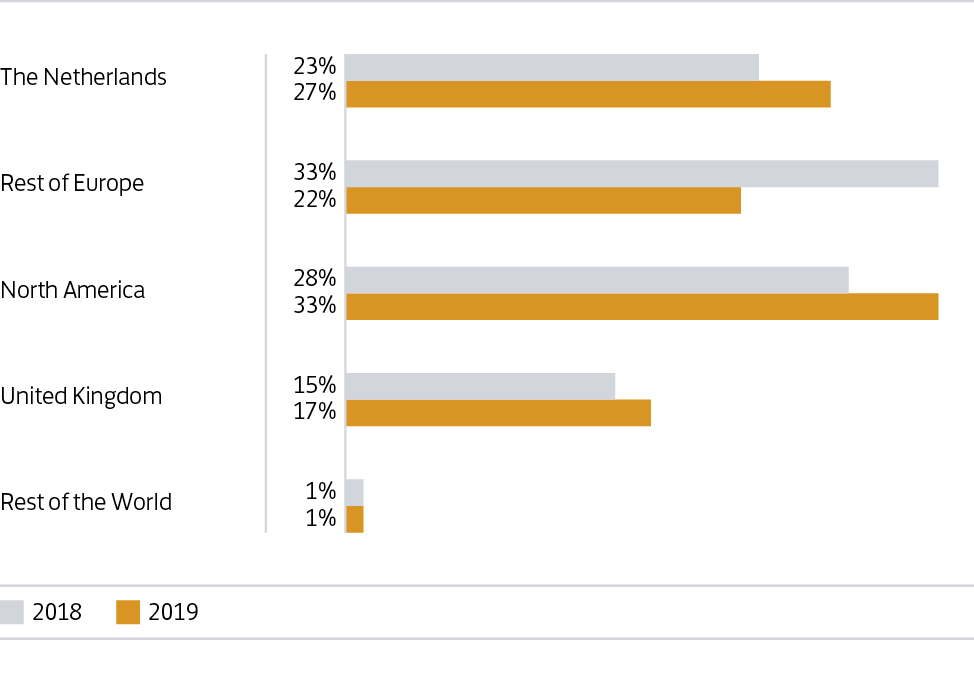

The distribution of our shares between retail (15%) and institutional shareholders (85%) did not change compared to 2018. PostNL has a broad base of international shareholders.

|