Tax payments in more detail

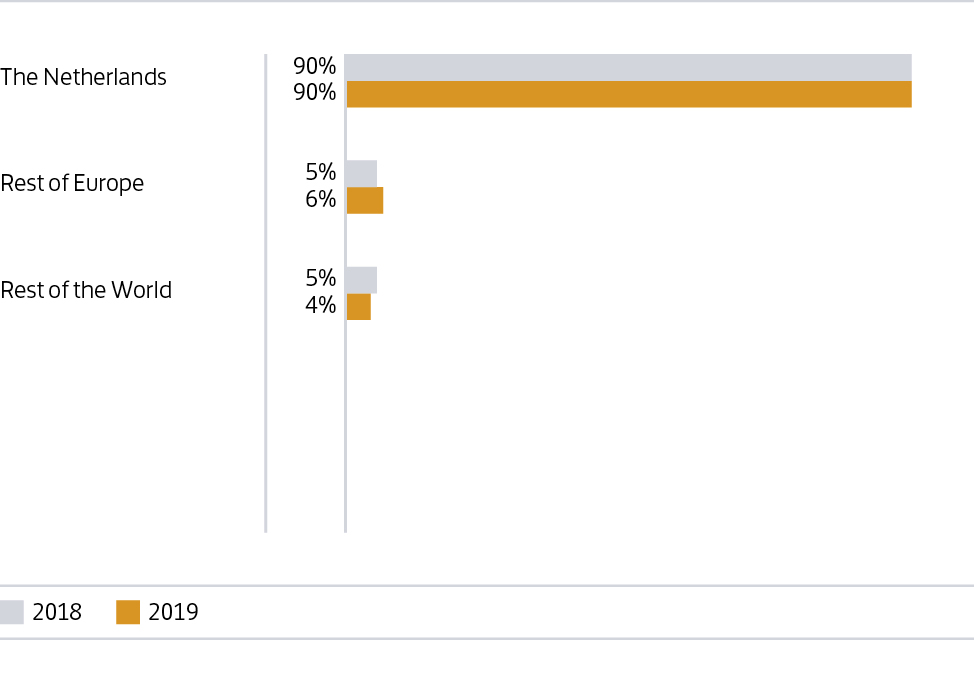

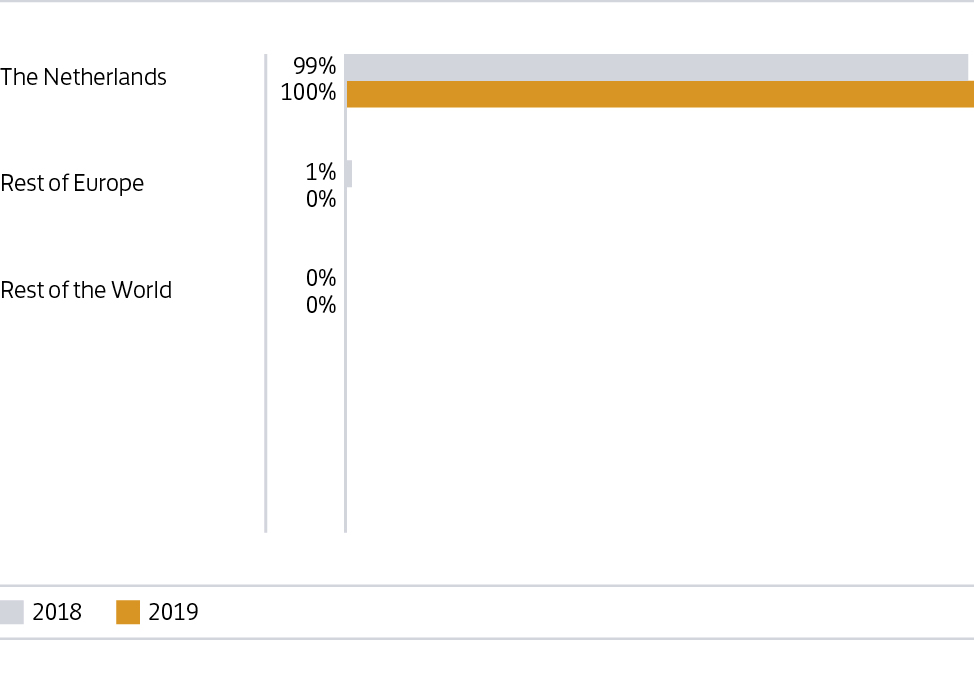

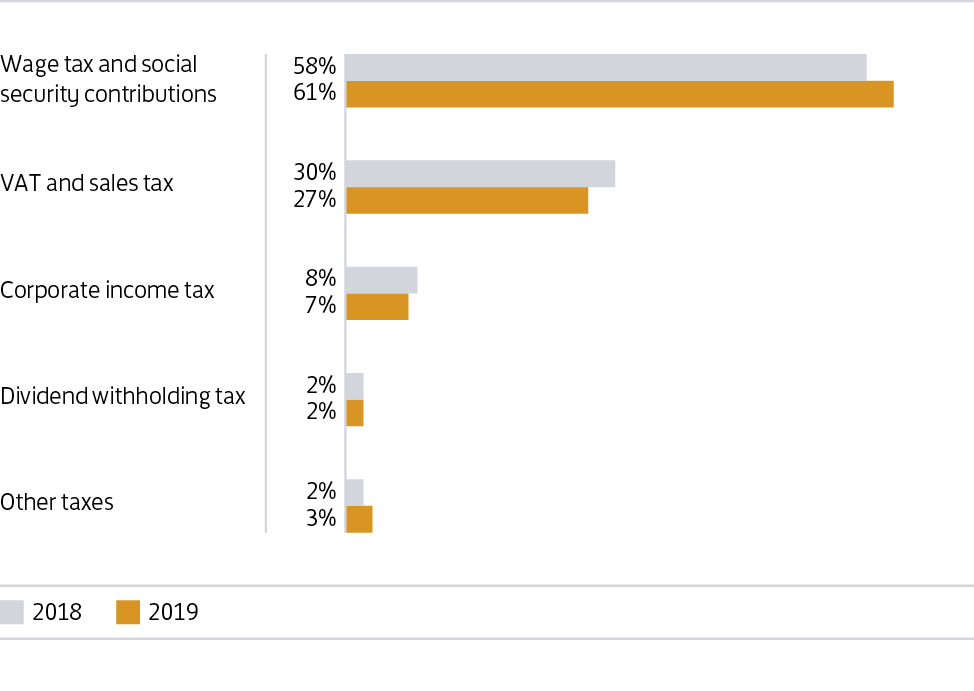

Given the different activities we operate across our business segments, we pay a number of different types of tax. In addition to corporate income tax, VAT & sales tax (borne and collected) and wage tax & social security contributions (borne and collected) are the most material ones. In 2019, we paid €478 million (2018: €511 million) in tax. A breakdown of these by type and region is shown in the charts below. Our revenue breakdown is included for comparison.

We monitor (inter)national developments (in particular developments in the OECD and EU context) to improve tax transparency. Complying with the legislation in the countries in which we operate our activities, we have filed a country-by-country report in the Netherlands and our notifications in other countries to the extent required. Also in 2019, these (inter)national developments were discussed on several occasions to assess whether our stance towards these developments should be adjusted. In terms of the outcome of these discussions, we continue to strive for optimal tax transparency, which includes taking the aforementioned developments, as well as competition considerations, into account.

PostNL Revenue by region

2018, 2019

PostNL Total taxes by region

2018, 2019

PostNL Total taxes by type

2018, 2019