Revenue and normalised EBIT

PostNL Business performance in € million

2023 - 2024

| Volume | Revenue | Normalised EBIT1 | ||||

|---|---|---|---|---|---|---|

| Year ended at 31 December | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 |

| Parcels | 3462 | 371 | 2,260 | 2,370 | 47 | 49 |

| Mail in the Netherlands | 1,745 | 1,605 | 1,373 | 1,338 | 50 | 19 |

| PostNL Other | 245 | 240 | (5) | (16) | ||

| Intercompany | (713) | (696) | ||||

| PostNL | 3,165 | 3,252 | 92 | 53 | ||

- Note: Normalised figures exclude one-offs in 2024 €15 million and in 2023 €7 million.

- As from 1 January 2024, parcel volumes also include domestic Belgian volumes. The comparative figure for 2023 has been adjusted accordingly (+3 million items)

PostNL applies the key performance indicators (KPIs) of revenue, normalised EBIT and free cash flow in its management analyses and reports on profitability performance. Normalised EBIT gives a reflection of the operating income performance, adjusted for the impact of project costs and incidentals. Free cash flow gives a reflection of our ability to generate cash available for dividend distributions, acquisitions, and/or debt repayments.

Normalised EBIT and free cash flow represent non-GAAP financial measures and should not be viewed in isolation as alternatives to the equivalent IFRS measures, which are presented in the consolidated financial statements, but should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have a standardised meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers.

Group

In 2024, revenue increased by 2.7% to €3,252 million (2023: €3,165 million). The global macroeconomic and geopolitical environment as well as customer behaviour impacted growth in domestic volumes at Parcels, while international volumes grew strongly. The structural volume decline continued at Mail in the Netherlands.

In 2024, normalised EBIT amounted to €53 million (2023: €92 million). The resulting margin, being normalised EBIT divided by total operating revenue, was 1.6% in 2024 (2023: 2.9%). Compared to 2023, normalised EBIT decreased by €39 million in 2024.

Normalised EBIT in 2024 includes €137 million in organic cost increases, of which around €118 million is explained by pressure on labour costs due to collective labour agreement increases, minimum wage increases and indexation of delivery partners. The remaining €19 million is caused by higher inflation and international transportation costs.

PostNL Normalised EBIT development in € million

Normalised EBIT excludes exceptional items, which amounted to €(15) million in 2024 (2023: €(7) million). Further information on the bridge from operating income to normalised EBIT can be found in note 2.7 Segment information to the Consolidated financial statements.

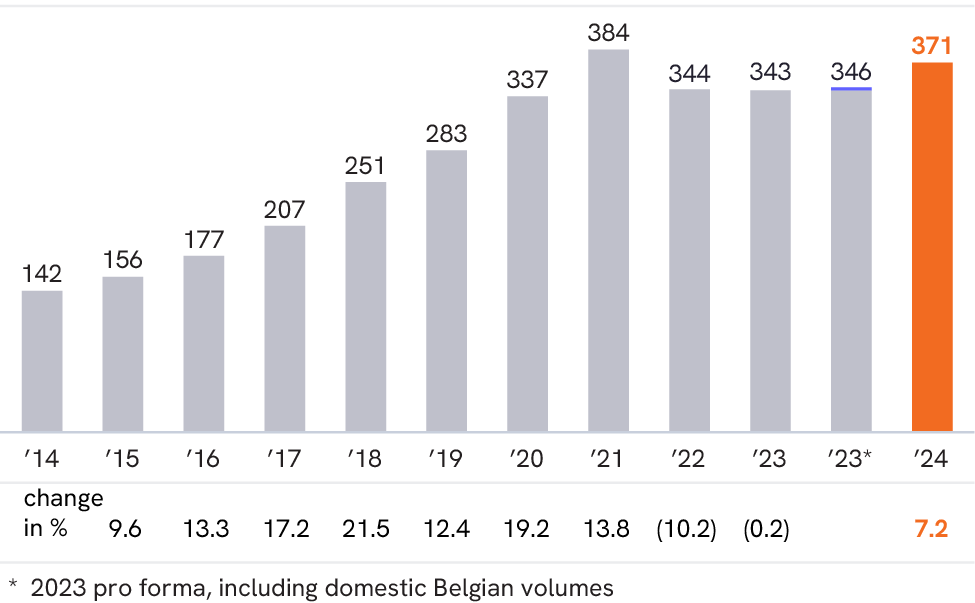

Parcels

In 2024, we delivered 371 million parcels (2023: 346 million, including domestic Belgian volumes, the comparative figure for 2023 has been adjusted: +3 million items). This resulted in a 7.2% volume growth compared to 2023.

Revenue grew to €2,370 million (2023: €2,260 million) driven by volume growth. However, the shift in product and customer mix was unfavourable while prices increased. Revenue at Spring was up, mainly driven by Asia.

PostNL Normalised EBIT Parcels in € million

Normalised EBIT increased by €2 million, from €47 million in 2023 to €49 million in 2024.

Organic costs increased by €62 million due to collective labour agreement increases, higher wage costs as the minimum wage increased and indexation of delivery partners. Other costs decreased by €34 million, mainly caused by efficiency improvements.

Other results increased by €10 million, amongst others caused by higher normalised EBIT from Logistics Solutions and Spring, driven by higher revenues.

Mail in the Netherlands

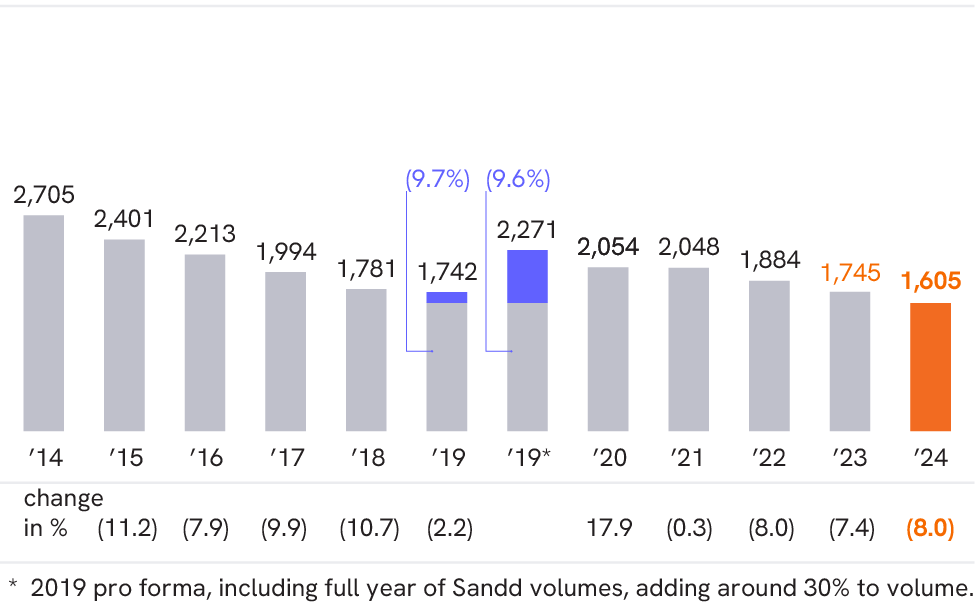

In 2024, we delivered 1,605 million items of mail (2023: 1,745 items). This resulted in a reported volume decline of (8.0)% compared to 2023, mainly due to ongoing substitution. The impact from elections was (1.1)%.

Revenue at Mail in the Netherlands decreased to €1,338 million (2023: €1,373 million), mainly showing the impact of the ongoing volume decline in addressed mail. The volume decline, combined with a positive price effect that was partly offset by a negative mix effect due to a shift in products, had an impact of €(29) million on the result of Mail in the Netherlands.

PostNL Normalised EBIT Mail in the Netherlands in € million

Normalised EBIT decreased by €31 million to €19 million (2023: €50 million). The net volume/price/mix effect of €(29) million was partly compensated by lower volume-dependent costs of €18 million. Organic costs increased by €47 million mainly due to collective labour agreement increases, increases to the minimum wage and inflation.

Other costs improved by €20 million, as cost savings of €41 million were partly offset by additional costs related to illness rates, staff shortages and some other, partly non-recurring, effects. Other results were up €7 million, mainly explained by international mail.

PostNL's position on the Future of Mail in the Netherlands can be found in the Our operating context chapter.

PostNL Other

Revenue at PostNL Other in 2024 amounted to €240 million (2023: €245 million). This revenue is mainly inter-company revenue related to IT. Normalised EBIT decreased from €(5) million in 2023 to €(16) million in 2024. The decline, amongst others, reflected organic costs increases and higher other costs, for example related to the co-title partnership with the cycle team dsm-firmenich PostNL (now: Picnic PostNL).

Personnel expenses

Salaries, pensions and social security contributions amounted to €1,120 million (2023: €1,100 million). An increase in costs due to collective labour agreement increases, increases to the minimum wage and higher additions to the WGA provision following a high rate of absenteeism, was partly offset by lower costs due to a decrease in FTEs from 20,851 in 2023 to 20,151 in 2024. The reduction of FTEs in 2024 related mainly to cost-savings initiatives within operations in Mail in the Netherlands. Additionally, the tight labour market impacted PostNL’s ability to maintain adequate staffing levels during 2024. Furthermore, absenteeism increased from 7.7% in 2023 to 8.5% in 2024.

“Thanks to well-executed cash and balance sheet management, we achieved our outlook for free cash flow and normalised comprehensive income”

Financial income and expense

In 2024, the net financial expense amounted to €8 million (2023: €2 million). The increase of €6 million was mainly due to higher interest expenses from the new sustainability-linked eurobond that was issued in June 2024, which replaced a bond with a lower coupon that matured in November 2024.

Income taxes

In 2024, the income tax expense amounted to €6 million (2023: €24 million). The decrease of €18 million is predominantly explained by the decrease in operating income.