To: the shareholders and Supervisory Board of PostNL N.V.

We have audited the financial statements 2020 of PostNL N.V. (hereinafter: PostNL or the Company), based in The Hague, the Netherlands.

In our opinion the accompanying financial statements give a true and fair view of the financial position of PostNL N.V. as at 31 December 2020, and of its result and its cash flows for 2020, in accordance with International Financial Reporting Standards, as adopted by the European Union (EU-IFRS), and with Part 9 of Book 2 of the Dutch Civil Code.

The financial statements comprise:

The consolidated and corporate statement of financial position as at 31 December 2020

The following statements for 2020: the consolidated and corporate income statement, the consolidated and corporate statement of comprehensive income, changes in equity and cash flows

The notes comprising a summary of the significant accounting policies and other explanatory information

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing. Our responsibilities under those standards are further described in the “Our responsibilities for the audit of the financial statements” section of our report.

We are independent of PostNL in accordance with the EU Regulation on specific requirements regarding statutory audit of public-interest entities, the “Wet toezicht accountantsorganisaties” (Wta, Audit firms supervision act), the “Verordening inzake de onafhankelijkheid van accountants bij assurance-opdrachten” (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence) and other relevant independence regulations in the Netherlands. Furthermore we have complied with the “Verordening gedrags- en beroepsregels accountants” (VGBA, Dutch Code of Ethics).

We believe the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

PostNL provides businesses and consumers in the Benelux with an extensive range of services for their mail and parcel needs, transforming from a traditional mail businesses into a logistics service provider. Through their international sales network Spring, they connect local businesses around the world to consumers globally. The group is structured in components and we tailor our group audit approach accordingly. We pay specific attention in our audit to a number of areas driven by the operations of the group and our risk assessment.

We start by determining materiality and identifying and assessing the risks of material misstatement of the financial statements, whether due to fraud, non-compliance with laws and regulations or error in order to design audit procedures responsive to those risks, and to obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

We were forced to perform our procedures to a greater extent remotely due to the Covid-19 measures. In order to compensate for the limitations related to physical presence and direct observation, we performed alternative procedures (for example reviewed key working papers electronically and held our meetings with the Company using video or teleconferencing facilities) to obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion.

Materiality | €12 million (2019: €7.5 million) |

Benchmark applied | 5% of normalised operating income |

Explanation | We consider an earnings-based measure as the most appropriate basis to determine materiality. We consider operating income to be the most appropriate earnings-based benchmark, as it provides us with a consistent year on year basis for determining materiality and is one of the key performance measures for the users of the financial statements. The benchmark applied is in line with last year’s audit. Compared to prior year materiality increased as a result of increased operating income. Since current years’ operating income is impacted by two material one off transactions, being the gain recorded on the sale-and-leaseback transaction of €60 million and accelerated write-down of Sandd assets of €14 million, we have adjusted operating income to come to a normalized operating income on which we based our materiality. |

We have also taken into account misstatements and/or possible misstatements that in our opinion are material for the users of the financial statements for qualitative reasons.

We agreed with the Supervisory Board that misstatements in excess of €600,000, which are identified during the audit, would be reported to them, as well as smaller misstatements that in our view must be reported on qualitative grounds.

PostNL is at the head of a group of entities. The financial information of this group is included in the consolidated financial statements of PostNL N.V.

Because we are ultimately responsible for the opinion, we are also responsible for directing, supervising and performing the group audit. In this respect we have determined the nature and extent of the audit procedures to be carried out for group entities. Decisive were the size and/or the risk profile of the group entities or operations. On this basis, we selected group entities for which an audit or review had to be carried out on the complete set of financial information or specific items.

Our group audit focused on significant group entities of PostNL N.V. within the segments Parcels, Mail in the Netherlands and PostNL Other. Based on their significance and/or risk characteristics, we performed full scope or specific scope audit procedures on the significant group entities within those segments.

For the entities in scope within Parcels, except for Spring Hong Kong, and Mail in the Netherlands the group engagement team performed the work. For Spring Hong Kong we used EY auditors from Hong Kong (component auditors), who are familiar with local laws and regulations, to perform audit procedures to obtain sufficient coverage for financial statement line items from a consolidated financial statements perspective.

Component materiality was determined by our judgement, based on the relative size of the component and our risk assessment. Component materiality did not exceed €6.0 million and the component auditor applied a component materiality that is significantly less than this threshold.

We sent detailed instructions to the component auditor, covering the significant areas that should be addressed and set out the information required to be reported to us. We interacted regularly with the component team where appropriate during various stages of the audit, reviewed key working papers and were responsible for the scope and direction of the audit process.

The group consolidation, financial disclosures and a number of complex items were audited by the group engagement team at the Company’s head office. These included among others goodwill and Mail investments impairment testing, the sale-and-leaseback transaction and pensions. We involved several EY specialists to assist the audit team, including specialists from our tax, valuations, real estate, actuarial and treasury departments.

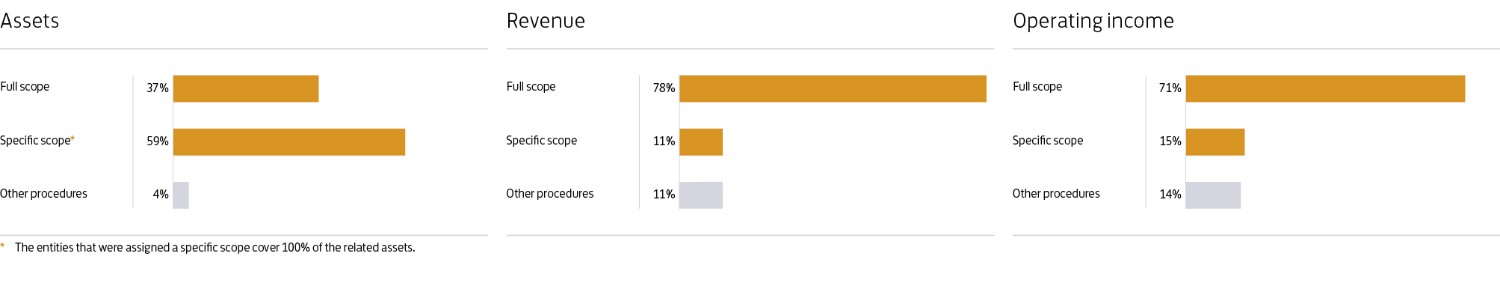

In total, in performing these procedures, we achieved, by performing full and specific scope procedures, the following coverage on the financial line items:

|

None of the components covered through other procedures (remaining components) individually represented more than 2% of total group revenue. For those remaining components we performed, amongst others, analytical procedures to corroborate our assessment that there were no significant risks of material misstatements within those components. By performing the procedures mentioned above at entity level, together with additional procedures at group level, we have been able to obtain sufficient and appropriate audit evidence about the group’s financial information to provide an opinion about the financial statements.

We performed our audit in cooperation with Internal Audit of PostNL, leveraging their in-depth knowledge of the Company and the work performed. We agreed about the joint coordination of the audit planning, the nature and scope of the work to be performed, the reporting and documentation. We evaluated and tested the relevant work performed by Internal Audit to satisfy ourselves that the work was adequate for our purposes and established what work had to be performed by our own professionals.

Our responsibility

Although we are not responsible for preventing fraud or non-compliance and cannot be expected to detect non-compliance with all laws and regulations, it is our responsibility to obtain reasonable assurance that the financial statements, taken as a whole, are free from material misstatement, whether caused by fraud or error. Non-compliance with laws and regulations may result in fines, litigation or other consequences for the Company that may have a material effect on the financial statements.

Our audit response related to fraud risks

In order to identify and assess the risks of material misstatements of the financial statements due to fraud, we obtained an understanding of the entity and its environment, including the entity’s internal control relevant to the audit and in order to design audit procedures that are appropriate in the circumstances. As in all of our audits, we addressed the risk of management override of internal control. We do not audit internal control per se for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

We considered available information and made enquiries of relevant executives, directors (including internal audit, integrity office, legal, compliance) and the Supervisory Board. As part of our process of identifying fraud risks, we evaluated fraud risk factors with respect to financial reporting fraud, misappropriation of assets and bribery and corruption in close co-operation with our forensic specialists. In our risk assessment we considered the potential impact of performance based bonus schemes which the Company has in place.

In our process of identifying fraud risks, we considered whether the Covid-19 pandemic gave rise to specific fraud risk factors resulting from a dilution in the effectiveness of controls as a result of the general disruption associated with remote working, illness, management overrides and workarounds, manual invoicing and manual payments and abuse of government schemes intended to support companies during the pandemic.

We evaluated the design and the implementation of internal controls that mitigate fraud risks. In addition, we performed procedures to evaluate key accounting estimates for management bias in particular relating to important judgement areas and significant accounting estimates as disclosed in note 3.1.4 of the consolidated primary statements and note 6.4.1 to the corporate primary statements. We have also used data analysis to identify and address high-risk journal entries.

We incorporated elements of unpredictability in our audit. We considered the outcome of our other audit procedures and evaluated whether any findings were indicative of fraud or non-compliance. If so, we reevaluate our assessment of fraud risk and its resulting impact on our audit procedures.

Our audit response related to risks of non-compliance with laws and regulations

We assessed factors related to the risks of non-compliance with laws and regulations that could reasonably be expected to have a material effect on the financial statements from our general industry experience, through discussions with the management board, reading minutes and inspection of reports of internal audit and the integrity committee and performing substantive tests of details of classes of transactions, account balances or disclosures.

We also inspected lawyers’ letters and correspondence with regulatory authorities and remained alert to any indication of (suspected) non-compliance throughout the audit. Finally, we obtained written representations that all known instances of non-compliance with laws and regulations have been disclosed to us.

We performed the following procedures in order to identify and assess the risks of going concern and to conclude on the appropriateness of management’s use of the going concern basis of accounting. The Board of Management made a specific assessment of the company’s ability to continue as a going concern and to continue its operations for at least the next 12 months. We discussed and evaluated the assessment with Board of Management exercising professional judgement and maintaining professional scepticism, and specifically focusing on the process followed by the Board of Management to make the assessment, management bias that could represent a risk, the impact of current events and conditions have on the company’s operations and forecasted cash flows, with a focus on whether the company will have sufficient liquidity to continue to meet its obligations as they fall due. We consider based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause a company to cease to continue as a going concern.

Our audit further included among others:

Performing audit procedures responsive to the risks identified, and obtaining audit evidence that is sufficient and appropriate to provide a basis for our opinion

Evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management

Evaluating the overall presentation, structure and content of the financial statements, including the disclosures

Evaluating whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements. We have communicated the key audit matters to the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters discussed.

In 2019 we identified the acquisition of Sandd and the discontinued operations as key audit matters. Since the determination of the fair value of the assets and liabilities as part of the purchase price allocation was completed in 2019, the 'Acquisition of Sandd' no longer qualifies as a key audit matter in 2020. Furthermore, the key audit matter ‘Discontinued operations', which mainly saw to the valuation of the business unit Nexive and the related deferred tax asset, is no longer considered a key audit matter since Nexive has been sold in 2020 and there is limited judgement in the valuation of the remaining originated deferred tax asset.

In 2020, the Company entered into a sale-and-leaseback transaction for several of their sorting centres which we have identified as a key audit matter.

The below matters were addressed in the context of our audit of the financial statements as a whole and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Risk | Our audit approach | Key observations |

|---|---|---|

Sale-and-leaseback transaction In 2020 PostNL entered into a sale-and-leaseback transaction for five of its sorting centres. The total consideration received amounted up to €150 million and a book gain of €60 million was recorded. The sorting centres are leased back for different periods, which vary between 5 and 10 years. PostNL has applied the sale-and-leaseback guidance under IFRS 16. We determined this to be a key audit matter, given the financial significance and complexity in applying IFRS 15 and IFRS 16 to a sale-and-leaseback transaction. First of all it needs to be determined whether the transaction qualifies as a sale in line with the requirements under IFRS 15. Secondly, the determination of the incremental borrowing rate (IBR) and whether the transaction price and the rental amounts are in line with market rates is relevant as these elements significantly impact the valuation of the right-of-use assets, the related lease liability and the result on the transaction. Further reference is made to note 2.1.2 to the consolidated primary statements. | We have designed and executed substantive audit procedures to verify the correct valuation of the right-of-use asset balance, relating lease liabilities and correct measurement of the recorded gain. We have inquired management regarding the application of IFRS 15 and IFRS 16, inspected underlying documents (e.g., signed contracts, valuation reports and e-mail correspondence) and performed recalculations. In addition, we have involved our EY real estate specialists to assist us in assessing whether the sales consideration and the agreed on rent are in accordance with the current market conditions. Our EY treasury specialists have assisted us in assessing whether the discount rate is reasonable. We have involved our EY tax specialists with respect to the related tax impact. | We note that the Company has appropriately accounted for the sale-and-leaseback transaction in line with IFRS 15 and IFRS 16 and that the key assumptions are reasonable. The sales consideration and the agreed on rent are in accordance with the current market conditions for logistic real estate. The risk premium included within the IBR falls within the range of our benchmark analysis. In addition, we assessed that the disclosures are appropriate. |

Revenue related accruals (terminal dues) The revenue related accruals of the Company mainly relate to outstanding positions with international postal operators for services provided (terminal dues). In several cases the prices and volume negotiations with the counterparties are not finalized, which results in assumptions being used by management in the measurement of revenue related accruals. The estimates used in the calculation of the terminal dues can have an impact on the operating revenues and accrued liabilities and is therefore important to our audit. Further reference is made to note 3.1.4 to the consolidated primary statements. In addition, the general accounting policy around revenue related accruals is disclosed in note 1.3 of the consolidated primary statements. | We have gained an understanding of the terminal dues and its revenue related accruals process, performed walk throughs of the revenue classes of transactions and evaluated the design of the relevant internal controls in this area. We performed detailed analytical review procedures on the terminal due positions, which included inquiry of management of the Company on the development of the postal volume and the status of the negotiations with the largest counterparties. We challenged this information with external reports received from other postal service providers on postal volume delivered to PostNL. We assessed the quality of the estimation process of management by performing back-testing procedures on the estimates of prior year by comparing those to final settlements in the current year. We performed test of details procedures on the contractual agreements on both volume and prices. We performed detailed procedures to determine the correctness of adjustments by substantiating the balances by agreeing the amounts to supporting documentation. We also assessed the appropriateness of the Company’s accounting policies in relation to revenue related accruals and the adequacy of the Company’s related disclosures as included in note 3.1.4 of the consolidated primary statements. | We note that the Company’s revenue recognition accounting policies were appropriately applied. Furthermore, we have assessed that the positions as per 31 December 2020 are management’s best estimate. In addition, we assessed that the disclosures are appropriate. |

Valuation Mail investments (corporate primary statements) At 31 December 2020 the value of Mail investments, as included in the corporate primary statements, amounted up to €3,002 million. At each balance sheet date, the Company reviews whether there is an indication that its Mail investments are impaired or whether there are indicators that a previously recognized impairment may no longer exist or may have decreased. Auditing the calculation of the recoverable amount is complex, given the significant judgement related to assumptions and data in the model used to determine whether the carrying value of the Mail investments is appropriate. Significant assumptions used in the model to support the recoverable amount of Mail investments are the discount rate and operating income. The assumptions and related changes, sensitivities and results of the tests performed are disclosed in note 6.4.1 of the corporate primary statements. In addition, the general accounting policy around impairment is disclosed in note 1.3 and 5.4 of the consolidated primary statements. | We have gained an understanding of the Mail investments impairment testing process, performed a walk through of the impairment analysis process (e.g. controls over the data and assumptions used in the analysis such as the discount rate and operating income) and evaluated the control design in this area. Our EY valuation specialists assisted us with our audit of PostNL’s annual impairment analysis. We reviewed the valuation model to assure that the methodology used is in line with IAS 36 Impairment of assets. We validated that the projected financial information used in the analysis was derived from PostNL’s most recent strategic plan and long-term forecast as approved by the Board of Management and Supervisory Board and have evaluated the historical accuracy of management’s assessment by comparing the historical actual results to the forecasts used. We challenged the assumptions and related changes used by the Company in their valuation model by comparing to external information such as discount rates and implied growth rates driving operating income. We confirmed that the cash flow projections are appropriate and consistent with the information approved by Board of Management and the Supervisory Board and we reconciled the carrying value to financial information from the accounting system. On top of the procedures mentioned before, we have assessed the impact of Covid-19 and challenged the sensitivity analysis as performed by the Company. In the sensitivity analysis for Mail investments the Company stress tested the key assumptions discount rate and operating income to calculate the impact of a change in assumption. We also assessed the adequacy of the Company’s disclosures around Mail investments as included in note 6.4.1 of the corporate primary statements. | We consider management’s assumptions to be within the acceptable range and we assessed that the disclosures for Mail investments are appropriate. The Company recorded an impairment reversal of €219 million in 2020. |

In addition to the financial statements and our auditor’s report thereon, the annual report contains other information that consists of:

The Report of the Board of Management

The Remuneration report

Other information as required by Part 9 of Book 2 of the Dutch Civil Code

Report of the Supervisory Board and Non-financial statements

Based on the following procedures performed, we conclude that the other information:

Is consistent with the financial statements and does not contain material misstatements

Contains the information as required by Part 9 of Book 2 and Sections 2:135b and 2:145 sub-section 2 of the Dutch Civil Code

We have read the other information. Based on our knowledge and understanding obtained through our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements. By performing these procedures, we comply with the requirements of Part 9 of Book 2 and Section 2:135b sub-section 7 of the Dutch Civil Code and the Dutch Standard 720. The scope of the procedures performed is substantially less than the scope of those performed in our audit of the financial statements.

Management is responsible for the preparation of the other information, including the Report of the Board of Management in accordance with Part 9 of Book 2 of the Dutch Civil Code, other information required by Part 9 of Book 2 of the Dutch Civil Code and the Remuneration report in accordance with Sections 2:135b and 2:145 sub‑section 2 of the Dutch Civil Code.

Following the appointment by the annual general meeting of shareholders on 14 April 2015, we were engaged by the Supervisory Board on 11 January 2016 as auditor of PostNL N.V., as of the audit for the year 2016 and have operated as statutory auditor since that date. We were re-appointed in the annual general meeting of shareholders on 16 April 2019.

We have not provided prohibited non-audit services as referred to in Article 5(1) of the EU Regulation on specific requirements regarding statutory audit of public-interest entities.

The Board of Management is responsible for the preparation and fair presentation of the financial statements in accordance with EU-IFRS and Part 9 of Book 2 of the Dutch Civil Code. Furthermore, the Board of Management is responsible for such internal control as the Board of Management determines is necessary to enable the preparation of the financial statements that are free from material misstatement, whether due to fraud or error.

As part of the preparation of the financial statements, the Board of Management is responsible for assessing the Company’s ability to continue as a going concern. Based on the financial reporting frameworks mentioned, the Board of Management should prepare the financial statements using the going concern basis of accounting unless the Board of Management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. The Board of Management should disclose events and circumstances that may cast significant doubt on the Company’s ability to continue as a going concern in the financial statements.

The Supervisory Board is responsible for overseeing the Company’s financial reporting process.

Our objective is to plan and perform the audit engagement in a manner that allows us to obtain sufficient and appropriate audit evidence for our opinion.

Our audit has been performed with a high, but not absolute, level of assurance, which means we may not detect all material errors and fraud during our audit.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. The materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion.

We have exercised professional judgement and have maintained professional scepticism throughout the audit, in accordance with Dutch Standards on Auditing, ethical requirements and independence requirements. The Our audit approach section above includes an informative summary of our responsibilities and the work performed as the basis for our opinion.

We communicate with the Supervisory Board regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant findings in internal control that we identify during our audit.

In this respect we also submit an additional report to the Supervisory Board in accordance with Article 11 of the EU Regulation on specific requirements regarding statutory audit of public-interest entities. The information included in this additional report is consistent with our audit opinion in this auditor’s report.

We provide the Supervisory Board with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with the Supervisory Board, we determine the key audit matters: those matters that were of most significance in the audit of the financial statements. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, not communicating the matter is in the public interest.

Amsterdam, 1 March 2021

Ernst & Young Accountants LLP

Signed by S.D.J. Overbeek-Goeseije